- Created by Anonymous, last modified by JohnW on Apr 01, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 3 Next »

https://help.myob.com/wiki/x/JINs

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

A customer credit is money that you owe to a customer.

To process a customer credit, you first need to record a credit transaction and then record the settlement of the credit (for example, by printing a refund cheque for your customer).

Recording credits

You can create a customer credit note in the following ways:

- Reverse an existing sale. Use this method if the customer has paid for the entire sale.

- Manually create a credit. Use this method if you are crediting the customer for part of a sale.

Before you can reverse an invoice, the transaction must be unchangeable, that is, the Transactions CAN’T be Changed; They Must Be Reversed option must be selected in the Security tab of the Preferences window.

- Find and open the invoice. See Finding a transaction.

- Go to the Edit menu and choose Reverse Sale. A credit note transaction is created in the Sales window. Note that the invoice amount is a negative amount.

If you want, you can make some changes to the credit note (such as changing the date and memo), but you can’t change the accounts, amounts and quantities that are associated with the credit. - Click Record Reversal. A customer credit appears in the Sales Register window.

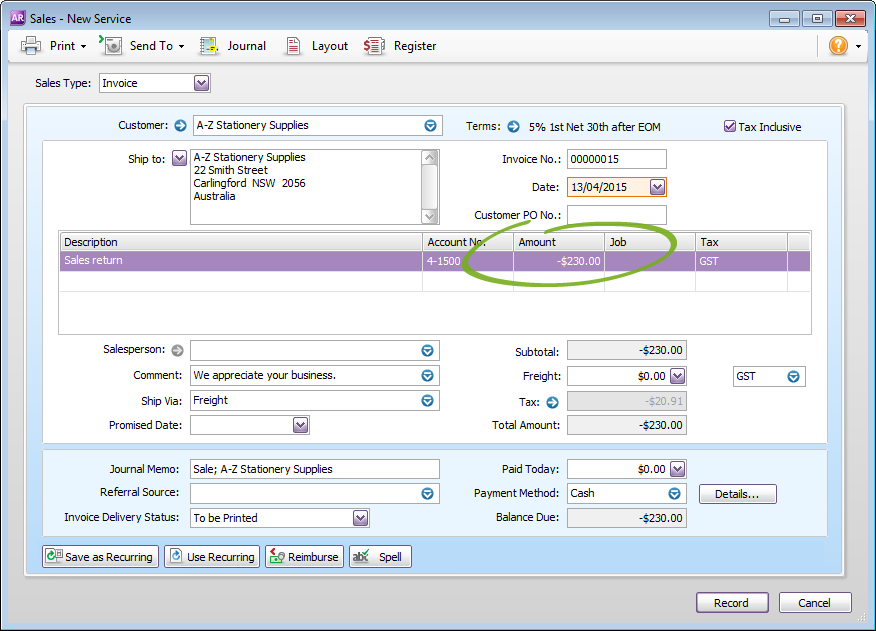

Use this method to credit the customer for part of a non-item sale.

Create an account for tracking sales returns

Before you manually create a credit of this type for the first time, you may want to create an account for tracking sales returns and allowances. Make sure this account is an income account.

- Go to the Sales command centre and click Enter Sales. The Sales window appears.

- Enter the customer details.

- Select Invoice from the list in the top left corner of the window.

- Click Layout, choose Service and click OK.

- In the Description column, enter a description of the credit for your records.

- In the Account column, select the account to be credited. This is the income account you use to track sales returns and allowances.

- In the Amount field, type the amount of the credit as a negative amount.

- Click Record . A credit appears in the Sales Register window.

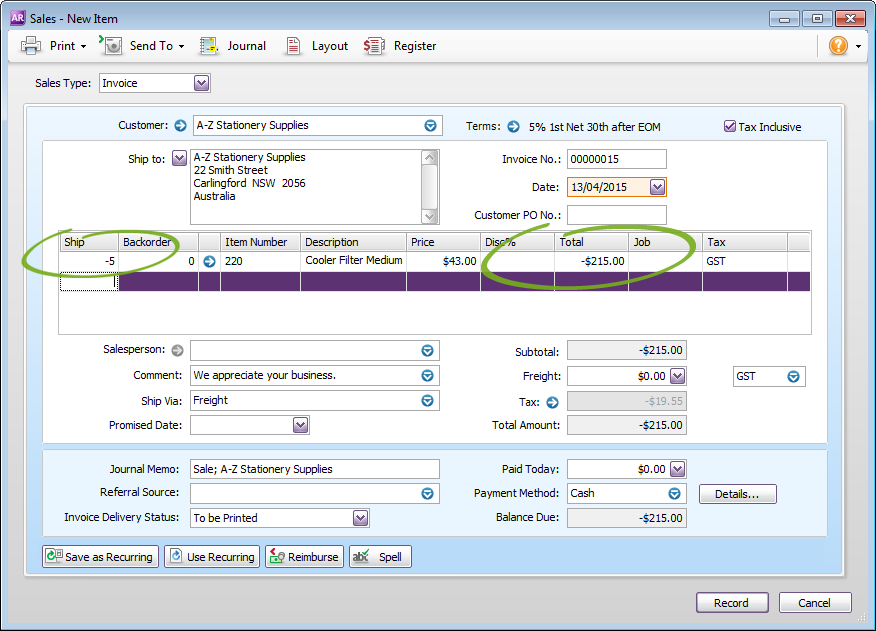

Use this method to credit the customer for part of an item sale.

- Go to the Sales command centre and click Enter Sales. The Sales window appears.

- Enter the customer details.

- Select Invoice from the list in the top left corner of the window.

- Click Layout and choose Item, then click OK.

- In the Ship column, type the number of items being returned as a negative number.

- In the Item Number field, enter the item number. The costs of the items appear as negative amounts.

- Click Record. A customer credit appears in the Sales Register window.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.