You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 13 Next »

https://help.myob.com/wiki/x/VgDYB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

If you need to adjust an employee's Employment Termination Payment (ETP) that you've reported to the ATO, you'll need to reverse the incorrect ETP pay. You'll then need to record a new pay with the correct ETP details.

This ensures the changes are submitted correctly to the ATO.

You can't adjust ETP Taxable and ETP Tax Free amounts by using negative values in a pay. Similarly, you can't adjust the ETP Tax Withheld using a positive number.

To fix an ETP

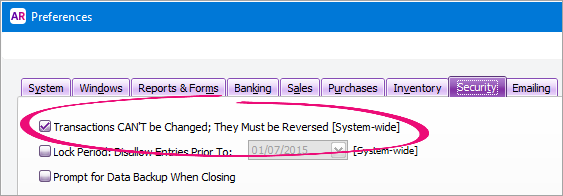

Set an AccountRight security preference to allow transactions to be reversed (go to the Setup menu > Preferences > Security tab > select the option Transactions CAN'T be Changed, They Must be Reversed > OK).

Display the pay to be reversed:

Click Find Transactions at the bottom of the Command Centre then click the Card tab.

Specify your search criteria to find the pay to be reversed.

Open the pay by clicking its zoom arrow (

).

).

Go to the Edit menu and choose Reverse Transaction. If you only see the option to Delete Transaction, check your security preference as shown in step 1.

If the pay being reversed is a cheque or electronic payment, a message will be displayed advising it will be recorded as cash. Click Yes to proceed.

Click OK to the following confirmation message:

Click Record to process the reversal.

- When prompted to declare the reversal to the ATO, enter the name of the Authorised sender and click Send.

You can now record the ETP again with the correct values.

When you terminated the employee, if you completed any of these tasks you'll need to undo them before re-recording the employee's ETP pay:

- If you added a termination date to the employee's card, you'll need to remove it.

- If you notified the ATO of the employee's termination date in the STP reporting centre, you'll need to remove the termination.

- If you finalised the employee in the STP reporting centre, you'll need to undo their finalisation.

- Go to the Card File command centre > Cards List > Employees tab > open the employee's card.

- Click the Payroll Details tab.

- (Optional) Click the blue zoom

arrow next to the Termination Date and take note of the employee's termination details (this will help when you need to add these details back later).

arrow next to the Termination Date and take note of the employee's termination details (this will help when you need to add these details back later). - Clear the Termination Date (click to highlight the date and press the <Delete> key on your keyboard).

- Click OK.

How you remove the termination depends on whether you're set up for STP Phase 1 or STP Phase 2. If you set up STP after mid-December 2021, you're likely on STP Phase 2.

The easiest way to check is to look in one of your wage categories:

- Sign in to your company file and go to the Payroll command centre > Payroll Categories.

- Click the zoom arrow

to open a wage category.

to open a wage category. - Check how many ATO Reporting Category fields there are.

- If there are two ATO Reporting Category fields (and a message about "STP Phase 2 is coming", you're on STP Phase 1 — which is fine!

- If there's only one ATO Reporting Category field, your file is set up for STP Phase 2.

To remove the termination

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the Employment terminations tab.

- Choose the Payroll year.

For the employee whose termination you need to remove, click the ellipsis

button and choose Remove termination.

button and choose Remove termination.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the Employee terminations tab.

- Choose the Payroll year.

Click X Undo for the employee.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

If the employee has been finalised, they will have the Final indicator ticked in the STP reporting centre.

If this is the case for the terminated employee, you'll need to undo their finalisation like this:

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the EOFY Finalisation tab.

- Choose the Payroll year.

- Remove the finalisation. How you do this depends on what you see.

- If there's an ellipsis

button next to the employee, click it and choose Remove finalisation.

button next to the employee, click it and choose Remove finalisation. - If there is no ellipsis button, select the employee and click Remove finalisation and notify the ATO.

- If there's an ellipsis

- When prompted to send your payroll information to the ATO, enter your details and click Send. The Final indicator tick is removed for the employee. If it's still there, click a different tab then return to the EOFY Finalisation tab.

You can now record the employee's ETP pay with the correct details.

To record the ETP pay:

- Go to the Payroll command centre and click Process Payroll.

- In the Pay Period section, click Process individual employee and type or select the employee you want to process in the adjacent field.

- Click Next.

- Click the zoom arrow (

) next to the employee’s name to display their pay details.

) next to the employee’s name to display their pay details. Enter the applicable amounts against the ETP Taxable, ETP Tax Free and ETP Tax Withheld payroll categories. If unsure about these amounts, check with your accounting advisor.

Here's an example:

Click ETP Benefit Type

This button only appears once you've entered values against an ETP wage category in the pay. If it doesn't appear after entering values against an ETP wage category, check that your ETP wage categories have an ETP ATO Reporting Category selected, such as ETP - Taxable Component, or ETP - Tax Free Component.

- Choose the applicable Benefit Type and Benefit Code. If unsure, check with the ATO or your accounting advisor.

- Click OK.

- If leave should NOT accrue on this payment, enter 0.00 in the Hours column for the entitlements.

Click OK.

Click Record and declare the pay to the ATO.

You can now terminate the employee by:

- adding the termination details to the employee's card

- notify the ATO of the employee's termination date

- finalise the employee.

- Go to the Card File command centre > Cards List > Employees tab > open the employee's card.

- Click the Payroll Details tab.

- Enter or choose the employee's Termination Date.

- Click the blue zoom

arrow next to the Termination Date and click Yes to the waring message.

arrow next to the Termination Date and click Yes to the waring message. - Click the blue zoom

arrow again and enter the employee's termination details.

arrow again and enter the employee's termination details. - Click OK then click OK again.

Which steps do I follow?

How you notify the ATO of the termination depends on whether you're set up for STP Phase 1 or STP Phase 2. If you set up STP after mid-December 2021, you're likely on STP Phase 2.

The easiest way to check is to look in one of your wage categories:

- Sign in to your company file and go to the Payroll command centre > Payroll Categories.

- Click the zoom arrow

to open a wage category.

to open a wage category. - Check how many ATO Reporting Category fields there are.

- If there are two ATO Reporting Category fields (and a message about "STP Phase 2 is coming", you're on STP Phase 1 — which is fine!

- If there's only one ATO Reporting Category field, your file is set up for STP Phase 2.

To notify the ATO

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- Click the Employment terminations tab.

- Select the employee who's leaving, choose their last day of employment, then click Notify the ATO.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

This declaration is processed in the same way other STP reports, and it can take up to 72 hours to be accepted by the ATO. You can check the status of the report in the STP reporting centre.

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the Employee terminations tab.

- Choose the applicable Payroll year and click Add Termination.

- Enter the termination details and click Notify the ATO.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

This declaration is processed in the same way other STP reports, and it can take up to 72 hours to be accepted by the ATO. You can check the status of the report in the STP reporting centre.

- Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the EOFY Finalisation tab and choose the Payroll year you're finalising.

- If you need to report fringe benefits for the employee (what is this?):

- Click the ellipsis

button for the employee and choose Enter RFBA.

button for the employee and choose Enter RFBA. Enter in both the:

Reportable fringe benefits amount $

Reportable fringe benefits amount exempt from FBT under section 57A $

The combined value of these must be above the thresholds set by the ATO.

- Click Add amounts.

- Click the ellipsis

- Select the employee to be finalised, then click Set as Final.

- Enter the name of the Authorised sender and click Send.

TBC

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.