The Business Details page contains the essential details about your business. These include your business name and type, your ABN details (Australia) or IRD/GST Number (New Zealand), and your business and postal addresses. Many of these details were entered when you first started using MYOB Essentials, but they can be edited or updated at any time. Details added here are accessed by your accounts, reports, and other areas throughout MYOB Essentials. From the Business Details page, you can also use the Lock periods feature. Whether it's a pay rise or a pay cut, it's easy to update an employee's details in AccountRight. The same process is used for hourly based and salaried employees. If the employee's working arrangements are also changing, see Changing an employee from full time, part time or casual. Also, a pay rise might also mean the employee is owed back pay.

OK, let's step you through it: | UI Expand |

|---|

| expanded | true |

|---|

| title | To enter or edit your business details |

|---|

| On the Settings menu, click Business details.

The Business Details page appears.

In the first section of the pageEnter or edit your business’s Business name, Trading name, ABN/ACN and ABN Branch (Australia) or IRD/GST number (New Zealand), Phone Number, Fax Number, Email address and Website URL. | change an employee's salary or hourly rate |

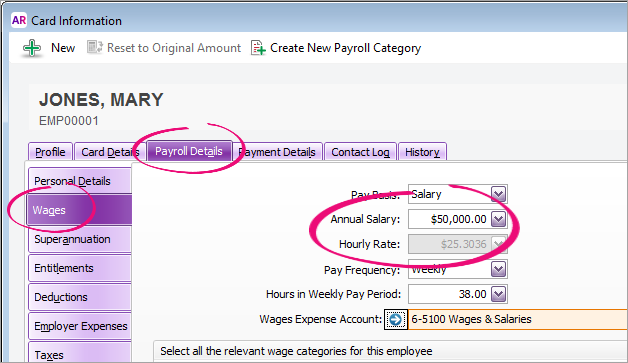

| To change an employee's salary or hourly rateGo to the Card File command centre and click Cards List. - Click the Employee tab.

- Click the blue zoom arrow

Image Added to open the applicable employee's card. Image Added to open the applicable employee's card. - Click the Payroll Details tab.

- Click the Wages tab.

Change the employee's Annual Salary or Hourly Rate.

Image Added Image Added | UI Text Box |

|---|

Mandatory fields The Business name field is mandatory. The ABN field (Australia only) is mandatory if you’re registered for GST. |

The Business type field is automatically completed, based on the business type you specified when you signed up to MYOB Essentials.

In the Business Address sectionEnter your business’s Address, City/Town, State/Region, Postcode and Country.

In the Postal Address section- If your business’s postal address is:

- the same as your business address, select the Same as business address option. The details in the business address section will be copied into the postal address section.

- not the same as your business address, enter or edit your postal Address, City/Town/Suburb, State, Postcode and Country.

- Click Save when finished.

| If an employee's Pay Basis is set to Salary, you can only change the Annual Salary value (the Hourly Rate is automatically calculated). Similarly, you can change the Hourly Rate for employees with a Pay Basis of Hourly. |

- Click OK. The employee's new pay rate will now apply.

|

| UI Text Box |

|---|

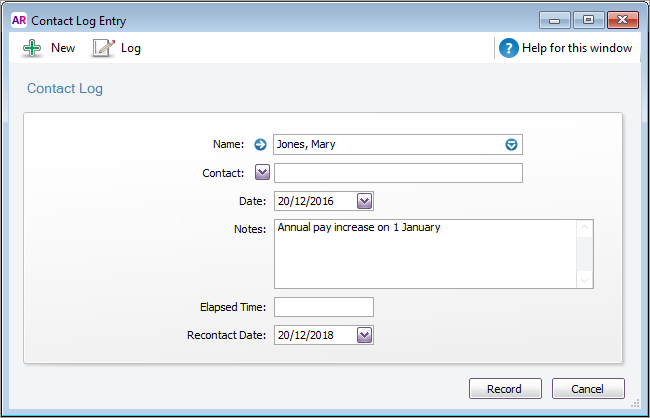

| Set a reminder for an annual pay increase If you have employees whose wage increases each year (say, on their birthday), create a contact log with a Recontact Date a few days before their birthday with a note to check pay rates.  Image Added Image Added

The reminder will appear in the Contact Alert tab of the To Do List on the Recontact Date. |

|