| Keypoints |

|---|

- This page lists released features and enhancements for all

|

of latest the features in MYOB Practice Tax (NZ).We're always adding more features. We'll keep this page updated with the latest changes, so make sure you bookmark this page and check back regularly! Learn more | UI Expand |

|---|

| - IR7 return: Allocate partnership income to partners.

|

| UI Expand |

|---|

| - Download tax statements for the IR3, IR3NR, IR526, IR7 and IR6.

|

| UI Expand |

|---|

| - Allocating trust income to beneficiaries in an IR6 return.

- Tax notices (Provisional and Terminal)

|

- areas of MYOB Practice.

- For MYOB and Inland Revenue (IR) outages affecting us, see the status hub.

- For NZ tax, see also the known issues page.

|

Jump to...| UI Text Box |

|---|

| If you can't find one of these features or enhancements in MYOB Practice, clear your browser's cache and refresh the MYOB Practice tab. If you still can't see it, your practice may not have access to that feature. |

Tax| UI Expand |

|---|

| 5 December Improved tax return navigation experience  Image Added Image Added

- The navigation panel is moved from the right of the page to the left.

- The navigation panel will highlight which section and subsection you're in to help you quickly scan the list of sections and see where you’re located.

- Each section of the navigation panel has its own scroll bar, instead of the one scroll bar for the whole panel. When you scroll one section, the other sections will no longer be scrolled out of view.

- The Tax workpapers & schedules and IR attachments sections in the navigation bar are renamed and combined into an Attachments and worksheets section and divided into subsections for each of these types of attachments.

- You may notice some other changes to the navigation bar order to create a consistent experience.

- When you scroll through a tax return, the section header will remain at the top of the page so that you always know which section you’re in.

- When you open a tax return, the Contacts side menu will be hidden to let you focus on the tax return. You can always show the side menu again by clicking Open side menu (the > greater than symbol) or by pressing the square bracket ([) keyboard shortcut.

Image Added Image Added

|

| UI Expand |

|---|

| 16 November Transfers out are easier to work withWhen you add transfers out to a tax return, they'll be shown in the tax statement separately to the Payments and transfers section. - Easily identify attachments, workpapers and schedules

You'll see a unique identifier beneath the name of the attachment, workpaper or schedule on the panel next to the return if there are multiple attachments, etc. of the same type:

Image Added Image Added

- An IR833 will show address line 1.

- The Business income statement will show the type of business.

- The Rental income statement will show the full address.

|

| UI Expand |

|---|

| 19 October 4 October More ways to add comments to tax returns In September we introduced the ability to add comments to the Compliance list page. Now you can also add comments when you open an individual tax return from the Compliance list page. You can add and view the comment from the Data reconciliation, Tax return or Documents sub tabs.  Image Added Image Added

Comments are synced between an opened tax return and the Compliance list views.

Learn more about adding comment.

|

| UI Expand |

|---|

| 27 September - Make notes about tax returns and share your thoughts with your colleagues

You can add comments to tax returns to track and share information with other users in your practice. Learn more about adding comments.

|

| UI Expand |

|---|

| 31 August - Improvements to working with workpapers and schedules

- When you enter data in a workpaper or schedule and the changes are automatically saved, you'll see a message saying "Autosaved. Close browser tab when done." This helps you know that it's safe to navigate away from the page without losing data.

Image Added Image Added - Your browser tab title shows the name of the workpaper or schedule that's opened, along with initials to help identify the client or contact (for example, AR). This makes it easier to switch between tabs without gettings lost when you have multiple MYOB Practice tabs open. Previously, all MYOB Practice tabs had the same title.

Image Added Image Added - The workpaper or schedule name will remain displayed at the top of the page if you scroll down the page. This makes it easier to remember which workpaper or schedule you're in if you switch to another tab or window and then return to the workpaper or schedule.

15 August 14 August Updates to Transaction Data Service (TDS) Inland Revenue (IR) have made changes to the TDS model. This changes the way that receiving your client's data works when the data is refreshed automatically or when you click Refresh IR data. This new model improves the way that data is retrieved so that it can happen faster. There's nothing you need to do to enable this and there are no changes to your workflow. | UI Text Box |

|---|

| We're releasing this update to different groups of customers over the coming weeks. |

3 August |

| UI Expand |

|---|

| 12 July - Quickly see the most relevant tax returns

The Compliance list Period filter defaults to the current financial year.

Image Added Image Added

|

| UI Expand |

|---|

| 2 April - Tax compliance for 2023 is here!

You've got all the latest updates you need for the new tax year, including:

- rolling over tax return and compliance settings data from the previous year

- rate changes

- residential property income

- IR3 – Overseas income

- IR3NR – Jurisdiction of tax residency

- IR8 – Māori authorities

- IR9 – Clubs or societies

- other changes and resolved issues.

Learn more about all the details.

|

| UI Expand |

|---|

| 31 March - Manage your practice’s tax-related roles

You can now turn on and off tax-related roles for your practice. These roles let your practice decide which staff can approve, unlock and file tax returns. Previously, you needed to contact MYOB to enable these roles. Learn more about enabling tax roles

|

| UI Expand |

|---|

| 27 February Individuals only. NZ tax residents only. The MYOB Practice Tax notices page now supports interim student loan notices in addition to the usual provisional tax notices. Having separate notices for student loans and provisional tax is helpful because the two types of notices may have different due dates. Interim student loan notices replace the need for voluntary adjustments in a provisional tax notice. Learn more. |

| UI Expand |

|---|

| 19 January - More Use of money interest (UOMI) calculation methods for terminal tax notices

You can automatically include the UOMI calculation from the tax return, or select a date range to use for calculating expected UOMI for returns. You may want to use these methods if UOMI from IR isn't available because the return isn't yet assessed. Learn more.

Enhancements when adding a section (in a tax return)

We've made improvements when adding a section; you'll be able to add or delete sections as required. This will reduce any error 21 XML rejections from the IR that have been occurring due to a blank record.

|

Partner Hub| UI Expand |

|---|

| | UI Text Box |

|---|

| To find the Partner Hub, select Practice ( Image Added) on the left side of MYOB Practice. Image Added) on the left side of MYOB Practice. |

23 February

- Improvements to finding your way around the Partner Hub

We've added a new navigation bar to the top of the Partner Hub, so that you can easily find everything you need to know about the Partner Program and your team activity.

|

| Anchor |

|---|

| Otherimprovements |

|---|

| Otherimprovements |

|---|

|

Contacts and other improvementsIn-product help| UI Expand |

|---|

| MYOB Practice in-product help is here!Learn about the workflows by watching a video, reading our Help pages, or taking a quick tour without having to leave the product.  Image Added Image Added

You'll see this banner on the following pages in MYOB Practice - Transaction Processing

- Contacts

- Portals

Use the  Image Added toggle button (on the top right) close the window if you no longer need it. Image Added toggle button (on the top right) close the window if you no longer need it. |

| Anchor |

|---|

| Previousyears |

|---|

| Previousyears |

|---|

|

Previous years| UI Expand |

|---|

| | UI Expand |

|---|

| | UI Expand |

|---|

| expanded | true |

|---|

| title | December 2022 |

|---|

| NZ tax20 December Use of money interest (UOMI) calculation for terminal tax notices

In addition to terminal tax notices including UOMI from Inland Revenue (IR) when a tax return is assessed, an extra calculated amount is now included by default. This amount covers the interest from the date IR has calculated interest up to the terminal tax payment due date.

You can override or exclude the UOMI amount. You can also select another date to use for the extra interest amount or exclude the extra interest amount. | UI Text Box |

|---|

| The UOMI calculation applies to all tax years. If you need to change terminal tax notices before the 2022 tax year, which have passed their due date, check and correct the calculation if necessary. |

Learn more. - Use of money interest (UOMI) rates updated

We've updated the UOMI calculation in tax returns and tax notices to use Inland Revenue's (IR) latest interest rates. To learn more about the rates and the date that they come into effect, see the IR website.

1 December - Group your clients and contacts

If you only use MYOB Practice, you can now group:

- individuals

- companies

- trusts

- other organisations.

When you've created a group, you can search for members using their group name and navigate between them more easily. Each client and contact can belong to multiple groups. Learn more about groups.

If you use MYOB AE/AO, you’ll be able to see your family groups from the desktop software in MYOB Practice through contact sync.

|

| UI Expand |

|---|

| General11 November - Less disruption and waiting, more productivity and efficiency!

MYOB Practice got a speed boost. We think you’ll notice improvements in a few different places, including tax rollover and upgrades completing within 10 to 20 seconds, and some key pages loading faster. Load times are halved in some cases, helping you stay in the flow while you work.

|

| UI Expand |

|---|

| Partner Hub25 October

- Added referrals and active files to Overview page

As part of our updates to the Partner Program, you can now earn points through referrals and active client files. The points you earn from referrals and active files are now visible in the Overview page of the Partner Hub. We've also improved the Activities summary area on the Overview page so that it's clearer to see the activities that earn you points and a summary of your practice's progress.

25 October - Add and view salutations for your clients and contacts

If you only use MYOB Practice, you can now add salutations for your clients. Go to Contacts > Contact list and select a client by clicking anywhere in the client row to view their details on the same page. On the right side, you can edit the client and add their preferred name or title in the Salutation field.

If you use MYOB AE/AO, you’ll now see the salutation when you look at a client in your Contact list and in Client details.

NZ tax24 October - Tax returns can be made Ready to file in bulk

You can change the status of multiple tax returns at the same time from Pending signature to Ready to file.

Filing in bulk was previously mostly useful if you used portal in MYOB Practice to automatically move returns to a Ready to file status. This change makes it easier to file tax returns in bulk if you’re not a portal user.

Learn more.

17 October - Calculate the use of money interest (UOMI) amount

IR3, IR3NR, IR4 and IR6 only, 2022 tax year onwards

Tax returns now include a UOMI calculator that you can use to work out the amount for you. You can change the calculation parameters to change how the UOMI amount is calculated, or completely override the calculation to enter your own manually calculated UOMI amount.

If you previously entered a manually calculated UOMI amount, you can still view it for your reference. But if you want to include the UOMI amount in the tax statement, you need to use the new UOMI calculator fields.

Learn more.

4 October - Resolved issue with Compliance settings data failing to save

We've changed the requirements for compliance settings so that you only need to enter the current year. Learn more.

|

| UI Expand |

|---|

| NZ tax21 September - The Tax notices page spotlights the most urgent tax notices

The All clients view of the Tax notices page will be filtered to show the tax notices that are due next. This helps you see the most relevant upcoming tax notices straight away.

At the start of each month, the From date will be set to the 1st of the current month, and the To date will be set to the 15th of the next month (or the next closest working weekday). For example, on the 1/10/22 the tax notices are filtered to show those due between 1/10/22 to 15/11/22. Learn more.

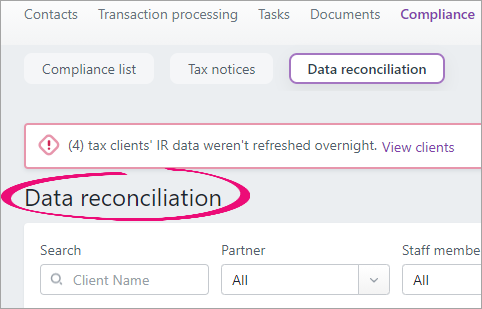

15 September - Add comments in the Data reconciliation All clients view

You can add comments to an entry in the All clients view of the Data reconciliation page. This can help you keep track of Data reconciliation work at a higher level than the individual transaction level. You could previously only add comments to transactions when you opened the Data reconciliation entry.

Learn more.

7 September Delete MYOB assessment transactions with a $0.00 value in Data reconciliation If you don't receive an IR tax return assessment because it has a $0.00 value, you previously couldn't delete the related MYOB assessment transaction in Data reconciliation, although you could delete all other transaction types with a $0.00 value. Now you can delete MYOB assessment transactions with a $0.00 value so you don't end up with unreconciled transactions that are no longer needed. Learn more.

|

| UI Expand |

|---|

| NZ tax18 August - Add comments in Data reconciliation entries

You can add comments to transactions when you open a client’s Data reconciliation entry. Learn more.

12 August Improved tax notice updates when settings change

If you change the GST taxable period, Balance month or Extension in your client's Compliance settings, we’ll automatically recreate future-dated tax notices to use the new due dates. You previously had to use a workaround to update the dates.

Image Added Image Added

Image Added Image Added

Image Added Image Added | UI Text Box |

|---|

| Sent or Paid tax notices in the same tax year will become read only and you’ll only be able to change their status from Sent to Paid. |

Learn more.

8 August - Download a convenient tax calculator

You can download a spreadsheet to help you easily calculate your client's tax. Learn more.

|

| UI Expand |

|---|

| NZ tax29 July 22 July - Tax notices are automatically created

MYOB Practice will automatically create tax notices for all your clients 3 months before they're due. You don’t need to do anything to create the notices. But if you prefer, you can also create an individual client's tax notices for the entire tax year. Learn more. Soon we’ll also be improving updates to tax notices when settings change. If your client has a change of balance month, GST taxable period, or extension, the future tax notices will be automatically updated to the new due dates. We’ll let you know when this features is available.

Portal21 July Save time when managing your tasks We’ve redesigned tasks so that you can select up to 100 tasks to complete and reopen in one action. You can also now sort tasks by client and due date so that you quickly find the most relevant tasks. Learn more about tasks.

20 July - Improved task reminders

We’ve improved the interface for Tasks so that it’s clearer that you’re sending your clients a reminder, not a new task. Your clients will also be sent improved email reminders that clearly show they’re task reminders, not new tasks. Learn more about sending a task reminder.

NZ tax14 July 6 July |

| UI Expand |

|---|

| NZ tax21 June - Use a 50/50 split for provisional tax instalments

You can now select whether a client is eligible to pay provisional tax in two equal instalments instead of the usual three instalments. This will calculate provisional tax using a 50/50 split and will be reflected in the tax return and tax statement. If you select this option, it will only be reflected in existing tax notices, returns and statements if they are in progress and aren't locked.

This option is only valid to use for one year for eligible clients. In the client's subsequent tax years, we’ll automatically change the two instalments to three instalments.

Previously, you had to use a voluntary adjustment to allow a 50/50 split.

Learn more, or set it up now in the year-based Compliance settings section of Client settings.

8 June - Filing tax returns is faster and more convenient

You can file tax returns in bulk! Select all the returns you want to file from the Compliance list and click File to send them all to IR.

Learn more.

Partner Hub1 June - Share your practice's Partner Program tier

In the Partner Hub, you can now download your status logo with your practice's Partner Program tier. Add the logos to your website, email signature or social media to showcase your tier. Learn more.

|

| UI Expand |

|---|

| Partner Hub26 May

- View the status credits you've earned from events

If your practice has earned status credits from attending an event, you can now see this under Program Activities. To see more detail and check who has registered for an event, click View Team Progress History and select the Events tab. Learn more about viewing team activities.

NZ tax25 May - Display the Data reconciliation entry you’re looking for faster

When you open a Data reconciliation entry, the entry that opens will now be for the most logical period based on where you open the entry from. Previously, when you opened a Data reconciliation entry, it would always open the latest period for the client and you’d often have to navigate to another period.

Learn more.

19 May - Quickly and easily see which Data reconcliation entries have alerts

The Data reconciliation list is sorted to display entries with alerts at the top of the list by default.

Partner Hub16 May - MYOB can provide you with targeted support more easiliy

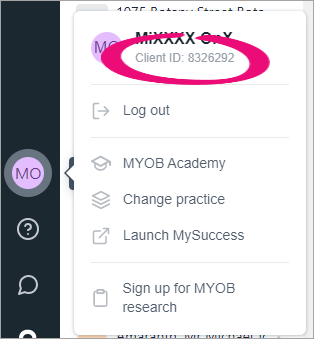

Your Client ID is displayed in the menu when you click the Your Profile button (your initials on the bottom left of the page) in the left menu bar. MYOB support may ask you for your client ID when you contact them for help.

Image Added Image Added

NZ tax10 May - Control how attribution of income/loss is distributed

In an IR7 partnership or look-through company return, you can edit the automatically calculated income/loss attribution values. Editing the value lets you specify the amount to be allocated, which is useful if the distribution isn't percentage based. Learn more.

Portal9 May - Improvements for Client Portal

Your clients can now upload multiple documents in one process. When clients do this, you'll receive one email notification for all the documents they've added in one upload.

Partner Hub5 May

- Program Activities added to Overview page

On the Overview page, you can now view a summary of your team’s activities and the amount of status credits they've earned. To see more detail of your team’s progress, click View Team Progress History to view their progress on certifications and the status credits they’ve earned during promotions. Learn more.

|

| UI Expand |

|---|

| NZ tax28 April - Refresh data for all tax types

Individuals only

The Refresh IRD INC data button in Data reconciliation is now the Refresh IR data button. You can use it to refresh data for all four tax types (Income tax, Tax credits, Student loan and Working for families). The previous button only refreshed data for income transactions.

Image Added Image Added

Learn more.

27 April - Better visibility on the period in which a Data reconciliation transaction took place

When viewing the Data reconciliation page in All clients view, each period is now displayed as its own row in the list of entries. Previously, each client’s entry displayed as one combined range of periods.

You can use new Period from and Period to drop-down lists to filter the entries by a period range or by a single period, to help you find the entry you’re looking for.

Image Added Image Added

You can also click a column header to sort the list of entries. For example, if you want to see all the entries with alerts at the top of the list, click the Alerts column header. If there are multiple entries for one client, these rows will always be displayed next to each other, to make it easier to see which entries belong to each client.

Learn more about Data reconciliation.

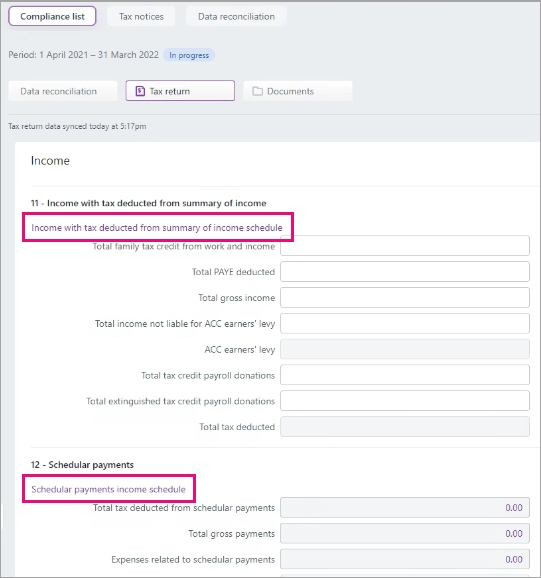

22 April - Easily create the right schedule or workpaper

If a section of the Compliance list > Tax return page has a related schedule or workpaper, you can click a link to add the schedule or workpaper directly from that section of the tax return.

Image Added Image Added

19 April - Display local date and time

Timestamps will be based on your system's local date and time, and will use a consistent format. You'll notice these changes in timestamps throughout your compliance work. For example, in the timestamps of filed returns.

13 April - Find unreconciled transactions from different periods more easily

When you open a Data reconciliation entry with unreconciled transactions, an alert at the top of the page displays the number of unreconciled transactions in each period, for each tax type.

Click the expand ( Image Added) icon to display the full alert. Image Added) icon to display the full alert.

Image Added Image Added

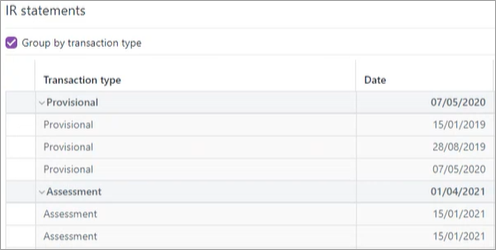

- More flexibility in how to view IR statement transactions

In the IR statements section of a Data reconciliation entry, you can select a Group by transaction type checkbox to sort the statement rows into collapsible groups.

Image Added Image Added

Learn more about Data reconciliation.

5 April - Automatic Overseas income schedule calculation

IR3 and IR4 only

The Overseas income schedule automatically calculates the claimable New Zealand tax credit portion of overseas tax payments. You may need to override the calculation in some circumstances. Learn more.

Documents5 April - Client’s profile automatically added to documents

When you receive documents in MYOB Practice from your clients through the Client Portal, the documents will now automatically have the client’s profile added to them. We’ll only add a client’s profile to documents when there is one client in the Client Portal.

Learn more about profiling documents.

NZ tax1 April - Tax compliance for 2022 is here!

You've got all the latest updates you need for the new tax year, including:

- rolling over tax return and compliance settings data from the previous year

- rate changes

- residential rental properties

- trust returns

- business continuity test

- government subsidy

- Working for families

- IRD number validation and errors

- 2022 tax statement usability and readability

- other tax return changes and resolved issues.

Learn more about all the details.

|

| UI Expand |

|---|

| Documents25 March - Fix for profiled documents

Previously, you may have had some issues with loading the Documents page when you’d added more than three profiles to a document. We’ve fixed this by reducing the amount of profiles you can see when you hover over the Clients column. Now, you will see up to three clients and if you’ve added more than three clients, it will show as Client, Client, Client, … more+

You can still view and edit all the profiles added to a document when you’re looking at the document’s details. The Client search also still works for finding clients that are profiled to a document. Learn more about profiling documents.

NZ tax23 March - Improved basis information for tax notices

More useful information is used and displayed in the Basis year field in provisional tax notices, and in the Basis column in the tax notice list view for provisional and terminal notices:The basis value will include the specific status of the tax return that's used as the basis for the tax notice. That status will be Not Started, Draft, Approved, Filed or Assessed. | UI Text Box |

|---|

| Draft could be In progress, In review or Ready for client. Approved could be Pending client signature, Ready to file or Rejected. |

- The Basis year value inside provisional notices will be displayed in a year-status format. For example, 2020 (Not Started).

For provisional tax notices, the Basis column in the tax notices list view will be displayed in a year-method-status format. For example, 2020 standard (Not Started). For terminal tax notices: The Basis column in the tax notices list view will be displayed in a year-type-status format. For example, 2020 terminal (Not Started). The Notice type column won’t display the year, only the type Terminal.

The status will also be displayed if you export the tax notices to a spreadsheet using the Export (XLSX) option.

If there’s no assessed, filed or approved tax return for last year or the year before last, we’ll use the year before last’s return as the basis year, which will have a Not Started or Draft status. Previously, the last year was used in this scenario. For example, following this change in 2022, if there was no approved return in 2020 and 2021, the basis year will default to 2020 instead of 2021.

Learn more about tax notices.

Learn more about exporting tax notices to a spreadsheet.

10 March Use tax return data in terminal tax notices without having to file the return | UI Text Box |

|---|

| These changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts. |

Previously, terminal tax notices were populated with tax return data such as RIT, taxable income and the notice amount when the tax return had a status of Filed.

Now, terminal tax notices are first populated with return data when you click Send to client on the return to change the return status to Pending client signature. Tax notices are populated with return data again when you click File with IR on the return to change the return status to Filed.

This makes it easier to get terminal tax notices with data from returns to your clients sooner, and means terminal tax notice data population works the same way as it does for provisional tax notices. | UI Text Box |

|---|

| Other ways that terminal tax notices get populated are by reconciled assessments received from IR, or from amounts that you manually enter into the notice. |

Learn more about terminal tax notices.

Learn more about tax notice and tax return statuses.

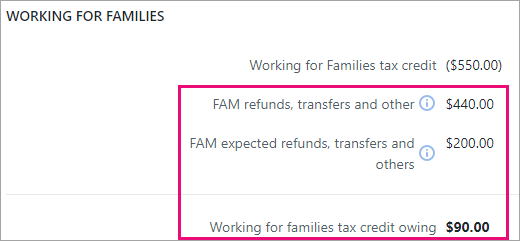

7 March 1 March Terminal tax notices automatically populate Working for families value

Individuals only | UI Text Box |

|---|

| These changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts. |

We’ve added three fields to the Terminal tax notices page to capture the breakdown of Working for families refunds received from, or owed to, IR.

Image Added Image Added

These fields automatically populate their amounts, and the amounts will be reflected in the Terminal tax - FAM field in the Tax notice summary section of the page. | UI Text Box |

|---|

| | You no longer need to use a FAM voluntary adjustment to display the correct amount on the tax notice PDF when Working for families is overpaid. |

Now that we’ve added these and other fields to the Payable amount section over the last few months, we’ve also added subheadings so it’s easier to see what tax types the amounts fall into.

Image Added Image Added

Learn more about the Working for families fields and other fields in the Payable amount section.

Learn more about tax notice and tax return statuses.

|

| UI Expand |

|---|

| Partner Hub18 February - You can now update your team size so that your practice earns the right amount of status credits. Learn more.

NZ tax15 February - Add comments to tax notices to make note of key points and to share your thoughts with your colleagues

You can add comments to tax notices to track and share information about a tax notice with other users in your practice. The comments are included if you export the Tax notices data to a spreadsheet. Learn more.

Image Added Image Added

Partner Hub15 February - In the Partner Hub Overview, we've added a progress bar for status credits so that you can now see how many status credits you've got.

|

| UI Expand |

|---|

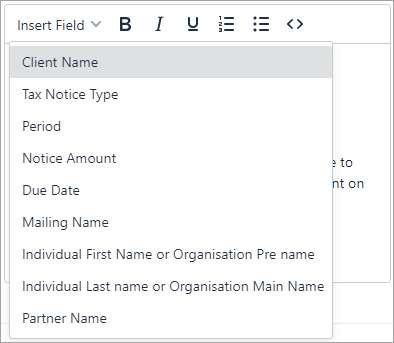

| NZ tax19 January Partner Email in tax notice messages We’ve added a new Partner Email field variable that you can insert into the email or Portal task text that’s used when you send tax notices to your clients. This field variable displays the email address of the partner in your practice who is associated with the client receiving the message. The email address that is used is the same email address that the partner uses to log in to my.myob. Insert the new field variable in MYOB Practice from the Insert Field drop-down in Settings > Compliance > Cover email text. Learn more.

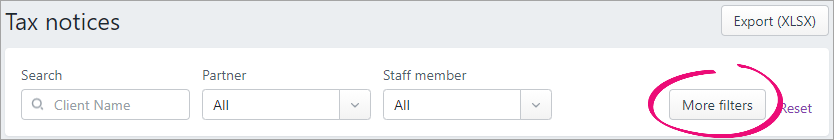

- Assessment filter on the Tax notices page

We've added an Assessment drop-down to the More filters options in the Tax notices filter bar. This filter lets you display tax notices that have income tax, Working for families or student loan assessment amounts. The filter checks for a value in residual income tax (INC), student loan repayment obligation (SLS) or Working for Families tax credit (FAM).

The assessment data is also included when you export the tax notices to a spreadsheet, depending on your Assessment drop-down selection.

Learn more about filtering.

13 January - Salutation in tax notice messages

We’ve added a new Salutation field variable that you can insert into the email or Portal task text that’s used when you send tax notices to your clients. This field variable displays a shorter version of the recipient’s name, for a more appropriate way of beginning a tax notice message. For example, Dear John instead of Dear John James Smith.

The Salutation value comes from your MYOB AE/AO desktop software. The value would have been set when you created the client. You can edit the value from the Client - [Name] > Main tab.

Insert the new field variable in MYOB Practice from the Insert Field drop-down in Settings > Compliance > Cover email text.

Learn more.

|

|

| UI Expand |

|---|

| | UI Expand |

|---|

| NZ tax21 December Terminal tax notices automatically populate more values | UI Text Box |

|---|

| - These changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts.

- There is an important voluntary adjustment workaround for an overpaid Working for families amount.

|

The Student loan repayment obligation field, Working for Families tax credit field and the fields in the Terminal tax basis section of the Tax notices page automatically populate their values from Data reconciliation or tax returns. Learn more about the Terminal tax basis and Payable amount sections.

Image Added Image Added

|

| UI Expand |

|---|

| NZ tax30 November Student loan terminal tax field improvements Individual entities only We’ve added to and renamed the student loan fields in the terminal Tax notices page to make them more useful and informative.

Image Added Image Added Student loan repayment obligation—We’ve renamed this field from Student loan repayment. This field is editable and you’ll need to manually enter the value. We’re working on making this field automatically calculate its value in a future update. SLS payments, transfers and other—This new field displays reconciled IR student loan transactions from the Data reconciliation page. SLS expected payments, transfers and other—This new field displays unreconciled MYOB student loan transactions from the Data reconciliation page. Student loan owing—We’ve renamed this field from Student loan repayment amount. This field displays the amount owing to IR.

If you’ve been using voluntary adjustments for recalculated student loan amounts, you’ll no longer need to use this workaround. These student loan field updates will automatically display the recalculated amounts. We’re continuing to work on bringing even more student loan improvements. Learn more about terminal tax.

8 November - More tax notice email customisation options

- If your MYOB Practice Administrator's added a footer or logo in the MYOB Practice Email notifications settings, the logo will be included when you send a tax notice.

- If you edit the default tax notice email or Portal task text, it's easier to apply formatting. Choose from the Cover email text field options, or click the source code icon (

Image Added) to use HTML elements. Image Added) to use HTML elements.

There are also more Insert Field variable options.

Image Added Image Added

Learn more.

4 November Portal1 November |

| UI Expand |

|---|

| Documents29 October - Document tile in Compliance

Access and upload documents for a particular year within the compliance. Learn more.

NZ tax27 October - Performance improvements on locked forms

We've improved the time it takes to open locked forms when you're filing a return.

22 October Details about transfers from other returns (Transfers received schedule)

You can create a Transfers received schedule that shows what a tax return’s Transfer from other returns value consists of. The schedule displays the tax type, client names and IRD numbers associated with incoming refund transfers. Previously on tax returns, you could only see the outgoing details of transfer recipients. | UI Text Box |

|---|

| The IRD number, tax type and amount will also continue to be visible in the tax statement. Note that Account type has been renamed to Tax type in the tax statement. |

Learn more. Edit the default tax notice email or Portal task text

MYOB Practice Administrators can edit the default email and Portal task text that’s used each time you send a tax notice. Edit the text in the Cover email text field in your MYOB Practice settings.  Image Added Image AddedYou can insert field variables to automatically populate specific sections of the email with relevant text, like the client name. You can use HTML elements to apply formatting to the email text. For example, you can enter a sentence between <p> and </p> to create a paragraph, or place a word between <b> and </b> to bold that word. Learn more about HTML text. - There’s also an option to send yourself a sample email to preview what the output will look like.

Learn more about setting the default text. | UI Text Box |

|---|

| - Changes you make to the Cover email text apply to all tax notice emails and Portal tasks sent to your practice’s clients. But if you're sending an individual tax notice rather than multiple tax notices in bulk, you’ll be given an opportunity to make once-off edits to the default text before sending the tax notice.

- We’ll be adding more field variable options soon. We're also looking into making additional enhancements to email editing options over this quarter. (Now available from 8 November!)

|

Portal26 October - Save time with task templates

You can save time by creating and using a task template when sending general tasks to your clients. Learn more.

NZ tax7 October |

| UI Expand |

|---|

| NZ tax30 September - Tax return PDF improvements

You can now choose to preview a tax return PDF in a new browser tab or download it directly. You could previously only download it. You can also choose to add a DRAFT watermark to the PDF.

As part of these changes, the Download button has changed to Preview (PDF) in the Compliance list > Tax return page, and the options are presented in a Preview documents window. Learn more.

Image Added Image Added - Easily sync, validate or preview a tax return from any section

When you scroll through a tax return, the Sync tax return data, Validate and Preview (PDF) buttons will remain visible.

Image Added Image Added

28 September - Delete transfers and refunds in Data reconciliation

You can now delete transfers and refunds created when you file a tax return. Learn more.

21 September 20 September Data reconciliation, MYOB transactions, and Working for families and Student loan schedules

We've got a lot of big and exciting features for you in this update! Read on to learn about improvements to Data reconciliation, MYOB transactions, and Working for families and Student loan schedules.

Some of these updates will impact how you work. We'd like to reassure you we're making these changes based on your feedback to improve our software and your experience in the long term. | UI Expand |

|---|

| title | Working for families calculations now available |

|---|

| IR3 only

Working for families tax credits calculations just got easier! Amounts are automatically calculated based on the data that you enter into the schedule. You previously had to manually calculate and enter the amounts. | UI Text Box |

|---|

| You can no longer manually enter or edit the tax credit entitlement amounts, but any previously entered amounts will remain in the schedule. If you want to use automatic calculations, delete the schedule, then add the schedule again and enter the dependant's details. |

Learn more. |

| UI Expand |

|---|

| title | Working for families schedule field is now prepopulated |

|---|

| The Working for families tax credits paid by Inland Revenue field is automatically populated with data synchronised from Data reconciliation transactions. You previously had to complete this field by manually entering the data. Learn more. | UI Text Box |

|---|

| - If you already have manually entered data...

...in the Working for families tax credits paid by Inland Revenue field of an existing schedule, this data won’t be overwritten with data from Data reconciliation transactions. If you want the field to use data synchronised from Data reconciliation transactions, delete the schedule, then add the schedule again and complete any manually editable fields. The automatically calculated fields will already be populated. - If you have in-progress tax notices...

...where you've added any voluntary adjustments, check the amounts in these tax notices. The voluntary amounts may already be taken into account by the fields automatically synchronised from Data reconciliation. If this is the case, you'll have a duplicated amount from the manual and automatic adjustment.

To fix tax notices with duplicated amounts, remove the voluntary adjustments in the tax notice.

|

|

| UI Expand |

|---|

| title | Student loan schedule fields are now prepopulated and included in tax statements |

|---|

| IR3 and IR3NR 2021 onwards The Total repayments made to IR and 20xx Total interim repayments made to IR fields are automatically populated with data synchronised from Data reconciliation transactions. You can't manually edit these fields. 20xx Total interim repayments made to IR is a new field, and you previously had to complete Total repayments made to IR by manually entering the data. The data from these fields is displayed in the tax statement in the Payment summary section in two new fields: 20xx Student loan interim and 20xx Student loan paid.  Image Added Image Added

If you have any approved tax notices with a status of Ready for client and you want to use the automatically populated data, you need to click Send for rework at the top of the tax notice to change the status back to In progress. | UI Text Box |

|---|

| - If you already have manually entered data...

...in the Total repayments made to IR field of an existing schedule, this data won’t be overwritten with data from Data reconciliation transactions. If you want the field to use data synchronised from Data reconciliation transactions, delete the schedule, then add the schedule again and complete any manually editable fields. The automatically calculated fields will already be populated. - If you have in-progress tax notices...

...where you've added any voluntary adjustments, check the amounts in these tax notices. The voluntary amounts may already be taken into account by the fields automatically synchronised from Data reconciliation. If this is the case, you'll have a duplicated amount from the manual and automatic adjustment.

To fix tax notices with duplicated amounts, remove the voluntary adjustments in the tax notice.

|

|

| UI Expand |

|---|

| title | Data reconciliation tax types and period summary |

|---|

| | UI Text Box |

|---|

| As part of the rollout of this feature, you may notice some unreconciled IR transactions from the last couple of days. If this happens, you can simply reconcile the transactions. We've automatically reconciled all transactions for the last 2 years for the SLS, WFF and REB tax types. |

View more tax types in Data reconciliation When viewing the Data reconciliation page in the client-centric view, you can select the Tax Type to display data related to that particular tax type. For individual entities, the Tax Type options are Income tax, Tax credits, Working for families or Student loan.  Image Added Image Added

For other entities, the Tax Type option is Income tax. Previously, you could only display income tax (INC) transactions for all entity types. The Tax Type options for individual entities give you more information for evaluating your clients' liability, giving you a complete picture of what a client’s tax position is for each tax type. These details will be included when preparing tax notices and tax returns, reducing the need for manual MYOB transactions or voluntary adjustments. We’ve also renamed the Refresh IR data button to Refresh IRD INC data because it can only refresh income tax data, regardless of which Tax Type you selected.  Image Added Image Added

New Period summary section in Data reconciliation When viewing the Data reconciliation page in the client-centric view, you now have a quick way to check the balance owing and assessment value for the selected period. You can view this information in the IR balance owing and Total IR assessment value fields under Period summary.  Image Added Image Added

IR balance owing—The balance value from the IR data feed for the tax type and period. Total IR assessment value—The total assessment value from the IR statements section of the page, for the tax type and period.

The Period summary section is available for all tax types. Learn more about Data reconciliation. |

| UI Expand |

|---|

| title | Capture MYOB transactions for provisional tax notices |

|---|

| We’ve made it easier to track MYOB transactions for expected future payments. There are a couple of new fields on the provisional Tax notices page to help with this, and a change to an existing field.  Image Added Image Added

- Payments & transfers—This existing field now only displays reconciled IR transactions from Data reconciliation.

- Tax pooling payments—This new field displays the tax pooling payment amount that was previously displayed alongside the Payments & transfers amount. The calculation hasn’t changed, but it’s easier to work with the amount in its own field.

| UI Text Box |

|---|

| This changes how tax notice calculations work. It's important that you check that amounts in any in-progress tax notices are correct before sending the notice for approval. Learn more. |

Learn more about provisional tax, the Tax notices workflow and the Data reconciliation workflow. |

16 September - New fields added when exporting Tax notices into Excel. Learn more.

9 September - Audit history

Administrators now have access to an audit history. It shows any changes made to the status of tax returns and any changes made to staff role assignment. Learn more.

|

| UI Expand |

|---|

| 6 August NZ tax31 August - Provisional tax option filter on the Tax notices page

We've added a Provisional tax option drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display provisional tax notices using only the standard option, only the estimation option, or all tax notices regardless of whether they are provisional tax notices. Learn more about filtering.

27 August - Voluntary adjustments filter on the Tax notices page

We've added a Voluntary adjustments drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display tax notices that have a voluntary adjustment. You can display:- tax notices with a specific voluntary adjustment type (for example, FAM, FBT, GST, INC or SLS)

- all tax notices with any voluntary adjustment type

- tax notices that don't have a voluntary adjustment

- all tax notices whether they have a voluntary adjustment or not.

Learn more about filtering.

Learn more about voluntary adjustments for provisional tax or terminal tax.

26 August - Delivery preference filter on the Tax notices page

We've added a Delivery preference drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display tax notices that are set to Send manually, Send task to client, Send email to client or All.

This is a useful filter to apply when selecting tax notices to send in bulk. The tax notices that need to be sent manually can't be sent in bulk, so this filter lets you easily exclude those tax notices. It also lets you easily see just those tax notices that you need to prepare for sending manually.

Learn more.

18 August - Assign users to roles in bulk

Now there's an easier way to control which users can perform certain actions in MYOB Practice in bulk. Learn more.

First, you'll need to have opted in to Access Management to assign staff to roles in bulk.

17 August - New filter options on the Tax notices page

We’ve added a Nil balance checkbox and Tax pooling drop-down to the More filters options in the Tax notices filter bar. You can use these options to filter the results displayed on the Tax notices page, which can be useful for performing bulk actions on a set of tax notices. Image Added Image Added

- Nil balance amounts:

Select the Nil balance checkbox to display tax notices with a 0.00 amount. - Tax pooling:

Select an option from the Tax pooling drop-down (Yes, No or All) to display tax notices based on whether the client is using tax pooling.

Image Added Image Added

Learn more about filtering, or tax pooling for provisional or terminal tax notices.

13 August - Send a copy of tax notice emails to your practice

When you send emails with tax notices to your clients, your practice can now receive a copy of the email. Your MYOB Practice Administrator will need to set a CC email address to use this feature.

Learn more about sending tax notices and about setting up the CC email address.

6 August 6 August NZ tax2 August - Minor Data reconciliation and Tax notices improvements

- You can see the Unreconciled transactions panel in Data reconciliation even when there are no currently unreconciled transactions. This means you can always access the Add MYOB transaction function. Learn more.

- In the Data reconciliation and Tax notices sections, wherever there were references to IRD in the user interface, these references are now displayed as IR.

- We’ve added a Data reconciliation heading above the filters in the All clients view.

Image Added Image Added

Documents1 August

- New limits when downloading from Documents within MYOB Practice

To improve the performance of Documents within MYOB Practice, we've introduced limits on the quantity and size of documents you can download in one go. You can now download 150 documents or 1 GB worth of documents, whichever one of these limits you reach first. Learn more.

|

| UI Expand |

|---|

| NZ tax21 July - Export Compliance list and Tax notices data to Excel

Reviewing compliance work just got easier! You can export data to an XLSX spreadsheet file, which can be a handy way to make and share notes and comments while reviewing. If you want to only include certain data sets, like only data relevant for a particular practice partner, you can also filter the data before exporting.

We've also removed the Export report (PDF) button. This option to export to Excel replaces the option to export to PDF.

Learn more about exporting in the Compliance list or in Tax notices.

19 July - Precise calculations when distributing income between partners in IR7 returns

Distribution calculations will use percentages to 4 decimal places instead of 2. IR allows percentages to 2 decimal places to be reported, so we’ve also added a new Percentage filed with IR field. See Entering data into a tax return in this link to learn more.

13 July - Automatically create tax workpapers when prepopulating returns

You no longer need to work out which workpaper or schedule to create when receiving data for prepopulating returns. We'll create the appropriate workpaper for you! Learn more.

9 July - Visibility of bank account details for refunds

When a tax return includes an amount to be refunded, you can see the bank account details that you previously set up in myIR and that will be used for the refund. If the bank account details in MYOB Practice don’t look right, you can refresh them to synchronise with the latest details in myIR. Learn more.

8 July NZ tax – Resolved issues

15 July - Fix for tax notices

When accessing tax notices, you won't get this error anymore: 'Something went wrong' (support ref: 00717130). Learn more.

13 July - Fix for tax notices

When you create a tax notice, the due date now shows correctly for six monthly clients with a June or December balance month (support ref: 00701371). Learn more.

7 July - Improvements and fixes for tax notices and returns

- In tax notice emails, the subject line now includes the name of the tax notice recipient (support ref: 00703152). Learn more.

- When you email your clients their tax notice, the attached notice will now be a PDF (support ref: 00648185). Learn more.

- You can now change the provisional tax option when the due date has passed (support ref: 00663088). Learn more.

- When schedular income is negative, it'll now be taken into account on your tax statement and displayed in Net schedular payments (support ref: 00672041). Learn more.

- If you change your client's name after you've created their tax notice, the tax notice will now show the updated name.

- After you've created a tax notice, the first instalment is correctly calculated in all cases. Previously, some notice's first instalments were incorrectly reduced by $1.

- Some tax notice's provisional tax was not being calculated when RIT was above $5000.

|

| UI Expand |

|---|

| NZ tax28 June Tax workpapers and schedules have an improved PDF layout

When you use the Tax workpapers & schedules side panel to create multiple workpapers and schedules for a tax return, they are combined onto one page wherever possible, without related content breaking across multiple pages. Learn more about preparing a tax return. - Access management for Tax notices and Data reconciliation

If you opt in to access management, you can use three new roles to control access to Tax notices and Data reconciliation functionality.- Tax notice approval role—Lets you approve and unlock tax notices.

- Sent tax notices role—Lets you send tax notices and change the tax notice status to Sent.

- Data reconciliation role—Lets you add, delete, reconcile or unreconcile transactions in a compliance data reconciliation.

| UI Text Box |

|---|

| If you've already opted in to access management, now only Administrators will have access to certain Tax notices and Data reconciliation functionality. To give access to other users, the Administrator must assign the new roles to those users. If you haven't opted in yet, you can register your interest to access all the features. |

Learn more.

24 June - Deleting IR526 returns

You can delete an IR526 if it has a status of In progress.

22 June - Added a validation to the IR4 company return

You’ll now see an error message if you haven't entered a value in the Lowest economic interests of shareholders percentage field. - Improved paragraph customisation

While editing paragraphs in tax notices and tax statements, you could previously press Enter to display the text on a new line break in the field. Now the line break will also display in the final tax notice or tax statement paragraph. We’ve also increased the maximum character limit in the Opening paragraph, Declaration and Footer paragraphs. Learn more.

16 June - Fixed known issue in tax returns

Payment summary—incorrect when provisional tax paid exceeds instalment due amount (support ref: 00651081). Learn more.

9 June - Fixed known issues

- IR4 errors for losses claimed and subvention payments

For an IR4, we have changed the validation errors to warnings when there are losses claimed and subvention payments. We've also updated the wording on the validations. - UOMI on tax statements

We've fixed an issue where a Use of money interest row was always printing in the IR4 and IR6 payment summary on the tax statement. The row will now only print if the amount is not 0.00. - Depreciation calculation

We've changed depreciation so that it will now be limited to the opening tax value. Before, the depreciation section in the Rental schedule in some scenarios was calculating depreciation greater than the opening tax value.

3 June Customise paragraphs in tax notices and tax statements

We’ve added the ability to edit the paragraphs displayed in tax notices and tax statements. We’ve also added an Additional text field, which will display an additional paragraph in tax statements. Some paragraphs come with default text, so you may want to review and edit these to suit your practice. Learn more. | UI Text Box |

|---|

| expanded | true |

|---|

| title | June 2021 |

|---|

| type | note |

|---|

| This feature doesn't include editing logos. We’re aware of the logo requirement. To learn when we schedule in this feature, keep your eye on the page for features coming soon. |

|

| UI Expand |

|---|

| NZ tax28 May - Business income schedule update

Based on your feedback, we've added a Depreciation subsection in the Other expenses section of the Business income schedule. This includes a new Depreciation field. The previously available Depreciation field is still available in the Expenses table to ensure previously entered data isn’t affected. You only need to complete one depreciation option.

Learn more about tax workpapers and schedules on the Compliance workflow page, in the Prepare a return > Table of tax workpapers & schedules section.

27 May 14 May - Tax compliance updates

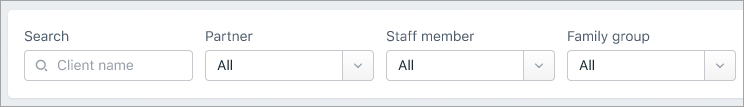

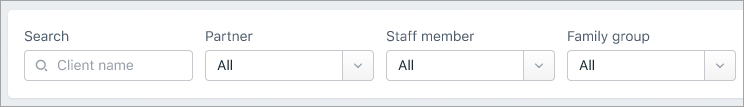

Individual entity types only: We’ve updated 2022 provisional and 2021 terminal tax notices to meet IR’s requirements. This applies to all existing and newly-created tax notices. Learn more. - Removed Partner and Family group filters for non AE/AO users

If you’re an MYOB Practice user who hasn’t come from MYOB AE/AO, we’ve removed the Partner and Family group filters from the Compliance, Tax notices and Data reconciliation lists. This is because partner and family group filters require data from AE/AO. You can still use the Staff member filter.

7 May 6 May - Even more data to share data between tax returns... with less effort!

You can distribute income from an IR6 tax return to a beneficiary's IR3 tax return, for the 2021 financial year onwards.

Plus you no longer need to work out which schedule to create! We'll create the appropriate schedule for you when you distribute from an IR4, IR6 or IR7 return to the IR3 return, if it's not already created. Learn more.

Transaction processing6 May - Create coding reports for MYOB Business files

You can now generate coding reports for clients with MYOB Business files. Previously, this was only possible for MYOB Essentials and MYOB AccountRight files.

|

| UI Expand |

|---|

| NZ tax23 April 21 April - New roles to help control user access to Compliance work

You can opt-in to access management. This gives your practice two new user roles for greater control over who can action Compliance work, like approving and filing returns. Learn more.

18 April - Save time by updating the status of tax notices in bulk

You can update the status of tax notices in bulk to Not started, In progress, In review, Ready for client, Sent, Paid or Not required, from the Tax notices list page. So if you have a lot of tax notices that you don't need to prepare or send, you can update all their statuses to Not required in one go without having to open the tax notice first. Learn more.

Image Added Image Added

Update—April 26: We added two more status update options: Not started and In progress.

12 April - View and edit GST settings

You can view and edit client GST settings that were imported from AE/AO. You can edit the details, but they won't sync back to AE/AO. Learn more.

8 April Filter Compliance list by staff, partner and/or family group

Effectively organise your workload with new filters for staff, partners and family group in the All clients view of the Compliance list page.

Image Added Image Added

Staff and partner assignments come from your clients' Responsibility tab in AE/AO, so make sure you've set up your team responsibility first. For family groups, you'll need to have set up family groups in AE/AO also. Learn more.

7 April - Even more data to share data between tax returns

Do even less manual entry and double handing by distributing income from an IR7 tax return to a partner or shareholder's IR3 tax return. Learn more.

1 April - Tax compliance changes

We've updated the legislative changes for the 2021 tax year. Learn more.

- Rollover 2020 tax returns to 2021

We'll create a 2021 tax return for every client with a 2020 tax return as of 31 March 2021. When you open this 2021 tax return, you'll have the option to roll forward the 2020 tax return. Learn more.

|

| UI Expand |

|---|

| NZ tax31 March - Filter Data reconciliation and Tax notices by staff, partner and/or family group

Effectively organise your workload with new filters for staff, partners and family group in the All clients view of the Data reconciliation and Tax notices page.

Image Added Image Added

Staff and partner assignments come from your clients' Responsibility tab in AE/AO, so make sure you've set up your team responsibility first. For family groups, you'll need to have set up family groups in AE/AO also.

Update: 14 May—We've removed Partner and Family group filters for non AE/AO users. See the 14 May What's new update to learn more.

25 March Pre-fill from workpapers into the IR10 form attached to a tax return

You can export IR10 data from AE/AO workpapers, and import it into MYOB Practice Tax to pre-fill the IR10 form. Learn more. Improvements when sending tax notices We've updated the wording in the email and portal message template used to send tax notices. Prefer to personalise your messages? You can still edit the wording when you send tax notices. If you’ve set up a practice alias, the tasks and emails to clients from MYOB Practice can be sent using the alias. Otherwise, tasks and emails sent from MYOB Practice will continue to use the logged-in user as the sender. Learn more.

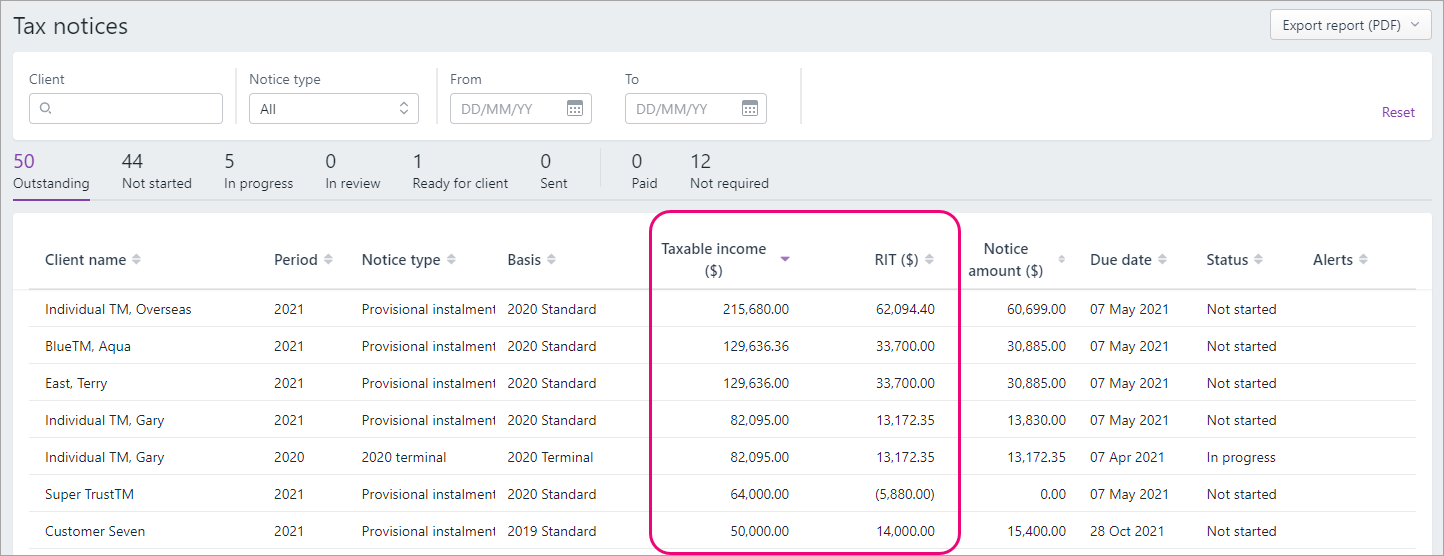

23 March - View Taxable Income and Residual Income Tax (RIT) at a glance

We've added two new columns to the Tax notices page to help you decide which tax notices need work.

Image Added Image Added

19 March - Prepopulate tax return data directly from Inland Revenue

When you add a tax return, we'll download data directly from Inland Revenue for you to prepopulate into your client's tax return. Learn more.

- New documents features

We're beginning the rollout of a new system for documents within MYOB Practice. When your practice has the new documents features, you can learn more here.

18 March - Pre-fill from AO Classic and AE MAS into the IR10 form attached to a tax return

You can export IR10 data from MYOB AO Classic and AE MAS, and import it into MYOB Practice Tax to pre-fill the IR10 form. Learn more.

- Share data between IR4 tax returns and IR3 tax returns

Do less manual entry and double handing by distributing income from a company’s IR4 tax return to a shareholder’s IR3 tax return. Learn more.

- Prepopulate association details when you create a tax return

You can now prepopulate the names and IRD numbers of shareholders, beneficiaries and partners from into an IR4, IR6 and IR7 return. This data comes from the associations in your client's MYOB Practice client details. Learn more.

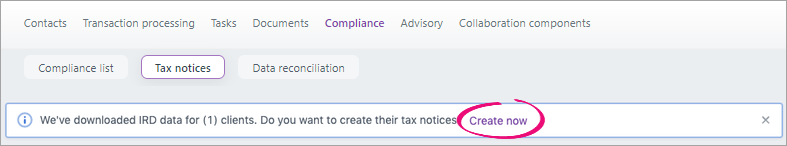

9 March - Create tax notices for multiple clients in one go

You can now create provisional and terminal tax notices for the current period, for multiple clients. On the Tax notices page, when you see the message "We've got data for (X) clients. Do you want to create their tax notices?", it means we've downloaded the latest Inland Revenue data for those clients. Click Create now to create their tax notices. Learn more.

Image Added Image Added Calculate provisional and terminal tax payable using Inland Revenue's assessment

When reconciling a transaction for the Inland Revenue's Residual Income Tax (RIT) assessment, you can now enter the details of the assessment in MYOB Practice. We'll then use these details to calculate provisional and terminal tax in your client's tax notices to ensure your client pays just the right amount of tax. Learn more.

3 March |

| UI Expand |

|---|

| NZ tax17 February 5 February - Easier navigation of Tax returns

Use the new Navigation options on the right of the Tax return page to jump straight to the section you want to view or update.

4 February - Filter by unreconciled transactions

We've added an Unreconciled transaction alert filter to the Data reconciliation page, so you can quickly find clients who have MYOB or IR transactions to reconcile.

3 February - Enjoy an improved upgrade experience

We've released a hotfix that corrects a couple of critical errors that you may see when you upgrade from MYOB AE/AO to MYOB Practice Tax. If you've installed MYOB AE/AO 5.4.36.144, it's important that you install this hotfix.

1 February - You can now delete tax returns in MYOB Practice Tax

If you've made a mistake when adding a tax return for your client, you can now delete and recreate it with the right information. Learn more.

|

| UI Expand |

|---|

| NZ tax5 January More flexibility in how you send tax notices

When you prepare a tax notice in MYOB Practice, you can now email the tax notice to your client directly from MYOB Practice! Learn more.  Image Added Image Added

|

|

| UI Expand |

|---|

| | UI Expand |

|---|

| NZ tax17 December - Prepare tax notices from MYOB Practice Tax

You can now prepare both provisional and terminal tax notices in MYOB Practice Tax. To get started, go to Compliance > Tax notices. You'll receive the message: We've downloaded IRD data for (X) clients. Do you want to create their tax notices? Click Create now to create tax notices for all your clients. See Preparing tax notices for information on how to get started.

Image Added Image Added

|

| UI Expand |

|---|

| NZ taxNovember 26

- Download tax statements for IR3, IR3NR, IR4, IR526, IR6 and IR7 returns

You can now easily generate professional-looking tax statements for the above return types. You can download the tax statement from the Tax return page or send it to your clients digitally, via the client portal.

|

|

|

|