| HTML |

|---|

<span data-swiftype-index="true"> |

| html-wrap |

|---|

| The final step to set Online company files only Once you've checked your payroll information, you can finish setting up Single Touch Payroll is to connect to (STP) by connecting to the ATO. Before you can connect, you'll need: - to connect to the internet (your AccountRight company file doesn't need to be online)

- to sign in to your MYOB account. If you don't have an MYOB account, you'll need to get one

- a Software Identification Number (SID). This is provided in your software as complete the steps below.

Learn how to connect to the ATO| HTML |

|---|

<iframe width="560" height="315" src="https://fast.wistia.com/embed/medias/vw4t16r7x8" frameborder="0" allowfullscreen></iframe>This notifies the ATO that you're using MYOB software to report your STP information. | Checklist |

|---|

| - Your business's ABN and contact details

- If you're a tax or BAS agent, you'll also need your own ABN, RAN and Access Manager login details

- If your business has reported pays to the ATO using STP in other payroll software in the current payroll year, you'll need that software's BMS ID. What's this?

|

Who needs to complete these steps?Each person who processes payroll for your business needs to complete these steps. If they don't have access to your company file, set them up. The steps you'll be prompted to complete depend on who you are and what steps have been completed already. Only the person setting up Single Touch Payroll will need to connect to the ATO for STP. Additional users will need to complete other steps to add themselves as declarers before they can send payroll information to the ATO. Learn more about adding another user as a declarer for Single Touch Payroll reporting. | UI Expand |

|---|

| expanded | true |

|---|

| title | To connect to the ATO |

|---|

|

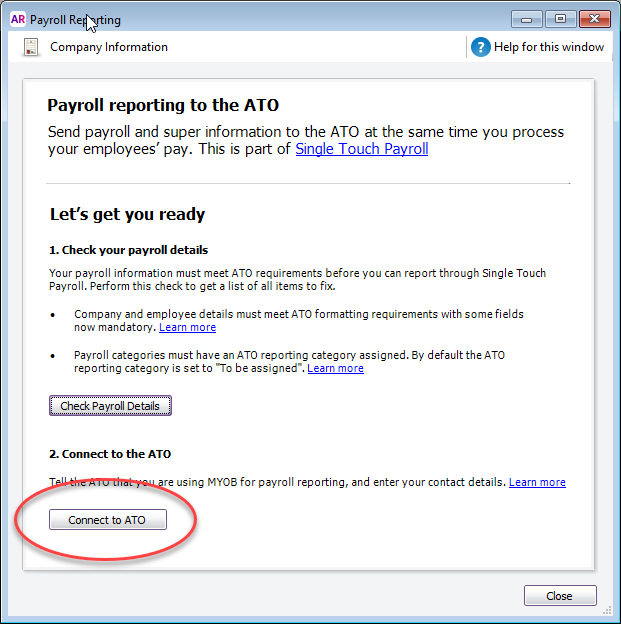

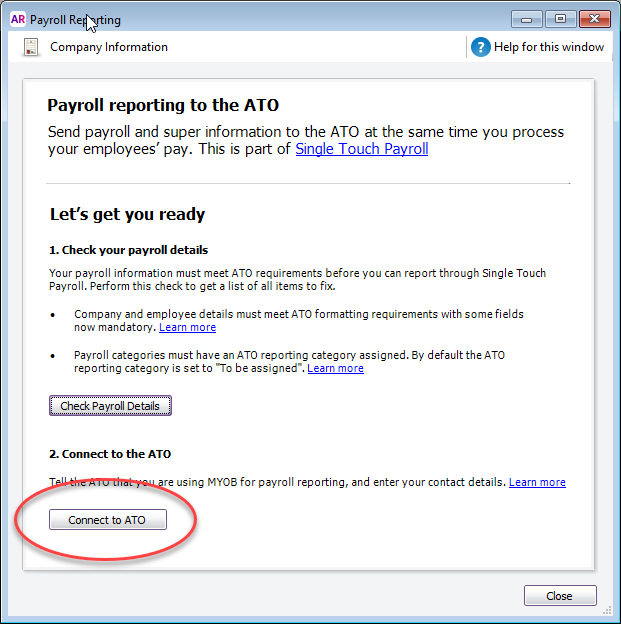

Go To connect to the ATO- If you haven't already, start the STP setup process and fix any identified issues (Payroll command centre

|

and click Payroll Reporting.

Image Removed Image Removed

Click Connect to ATO.

Image RemovedIf prompted, click Check Payroll Details to fix any issues with your payroll setup. the ATO connection. See the table below for guidance. Image RemovedIf prompted, click Check Payroll Details to fix any issues with your payroll setup. the ATO connection. See the table below for guidance. | | Steps |  Image Removed Image Removed

I process payroll for the business |  Image Removed Image Removed

I am a tax or BAS agent who works with the business |

|---|

1. Your role | - Someone from the business

- If you are not a tax or BAS agent, but process payroll for the business, choose this option. There are extra steps that a tax or BAS agent must do, that you don't have to.

| If you are a registered agent, there are a few extra steps you'll need to complete to set up. | 2. Declaration information |  Yes Yes |  Yes Yes |

|---|

Each person who processes payroll must enter their details. This is so we can identify who can sign the declaration when sending payroll reports to the ATO. New staff members will be prompted to enter their details when they go to Payroll > Payroll Reporting after you have connected to the ATO. Don't forget to check your ABN

The ABN you enter here must match the ABN entered (or checked) in the edit company information for Single Touch Payroll step when checking payroll details. If these ABNs don't match, your payroll information will be rejected and not send to the ATO. | | 3. Add clients to portal |  No No |  Yes Yes

If this hasn't been done already. This is done outside of MYOB in the tax or BAS agent portal. |

|---|

4. Notify ATO |  YesOnly one person from the business needs to notify the YesOnly one person from the business needs to notify the - setting up STP. For guidance, refer to the procedure below that's relevant for your role in the business.

| UI Expand |

|---|

| title | I'm someone from the business |

|---|

| Perform the steps below if you're someone from the business, such as the payroll officer for the business. | UI Text Box |

|---|

| You must complete these steps yourself. You can’t get your agent to complete these steps on your behalf. |

- Make sure you've got your ABN handy and click Start.

- At the Your role step, choose Someone from the business and click Next.

- At the Declaration information step, enter your details including your business's ABN, name and contact details and click Next. As you selected Someone from the business in step 2, you'll skip the Add clients step.

- At the Notify ATO step, you need to let the ATO know you're using MYOB for payroll reporting:

- Get the Software ID. This number is shown on screen at this step in MYOB and is unique to you and you can't share it - each client and agent will have their own. If you use the wrong Software ID, the ATO will reject your reports.

Choose how you want to notify the ATO. Option 1. Phone the ATO on 1300 85 22 32 | This only takes a few minutes. You'll need your own TFN or ABN handy, to verify your identity. - Follow the prompts and provide your unique Software ID and MYOB details when requested. This information is generated in MYOB and displayed in the page for this step.

- Once confirmed, click the I've notified the ATO.

| Option 2. Create notification in Access Manager | If you have an Access Manager you can notify the ATO online. You can also create an Access Manager account. Detailed instructions: Notifying us of a hosted SBR software service (ATO website). - Log into Access Manager.

- Click My hosted SBR software services from the left hand menu.

- Click Notify the ATO of your hosted service.

- Complete all steps with the unique Software ID and MYOB details.

- Once confirmed, click I've notified the ATO.

|

|

|

We recommend getting your client to go through these steps first, before you do this. | You must complete this step. If you don't notify the ATO using one of the notification confirmation options, the ATO will reject your reports. |

- Once you've notified the ATO that you're using MYOB software, click I've notified the ATO and in the confirmation message that appears, click Send.

At the Transferring BMS ID step, select whether your business has reported via STP using other payroll software in the current payroll year. See the FAQ below for more info about this. | If your business | Do this |

|---|

| has NOT reported via STP in other payroll software in the current payroll year | - Select No.

- Click Next.

| | HAS reported via STP in other payroll software in the current payroll year | - Select Yes.

- Enter the Previous software BMS ID. For help finding this, see the FAQ below.

- Click Report previous BMS ID.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

Transferring your BMS ID lets the ATO know you've changed payroll software, and moves your employee's year-to-date payroll amounts under your new BMS ID at the ATO end. If you haven't already, make sure you've entered your employee's pay history for the current payroll year into AccountRight. This ensures your employees' year-to-date pay amounts matches what you've reported via STP. | UI Text Box |

|---|

| Your previous software BMS ID must be accepted by the ATO before you can process any pays in MYOB. You can check the status of the submission in the STP reporting centre from AccountRight (Payroll command centre > Payroll reporting > Payroll Reporting Centre > STP reports tab). The ATO typically accept STP submissions within the hour but it can take them up to 72 hours during peak periods.

We also recommend accessing your AccountRight company file in a web browser to confirm your STP totals held by the ATO match what's in MYOB. |

|

And that's it — you're done! You can now click Go to STP reporting where you can view your Single Touch Payroll reports. Or you can close the web browser and go back to using AccountRight.  Image Added Image Added

Also find out what happens after you've set up Single Touch Payroll. |

| UI Expand |

|---|

| title | I am a tax or BAS agent who works with the business |

|---|

| Perform the steps below if you're you're a registered tax or BAS agent. | UI Text Box |

|---|

| You’ll need to enter your own details here, signed into MYOB as yourself. You cannot complete this on behalf of your client. |

- Make sure you've got your agent ABN and the business's ABN handy and click Start.

- At the Your role step:

- choose either A tax agent or A BAS agent

- enter your agent ABN and Registered Agent Number

- click Search to find your contact details – if you can't find these, you'll need to add them. Click Next.

- At the Declaration information step, enter your details including the business's ABN, your name and contact details and click Next.

- At the Add clients step, add this business to your client list in the Online Services for Agents (skip this step if they're already on your client list).

- Click I've added this client.

At the Notify ATO step, you need to let the ATO know you're using MYOB for payroll reporting. - Get the Software ID. This number is shown on screen at this step in MYOB and is unique to you and you can't share it - each client and agent will have their own. If you use the wrong Software ID, the ATO will reject your reports.

Choose how you want to notify the ATO. Option 1. Phone the ATO on 1300 85 22 32 | This only takes a few minutes. You'll need your own TFN, ABN or RAN (for agents) handy, to verify your identity. - Follow the prompts and provide your unique Software ID and MYOB details when requested. This information is generated in MYOB and displayed in the page for this step.

- Once confirmed, click I've notified the ATO.

| Option 2. Create notification in Access Manager | If you have an Access Manager you can notify the ATO online. You can also create an Access Manager account. Detailed instructions: Notifying us of a hosted SBR software service (ATO website). - Log into Access Manager.

- Click My hosted SBR software services from the left hand menu.

- Click Notify the ATO of your hosted service.

- Complete all steps with the unique Software ID and MYOB details.

- Once confirmed, click I've notified the ATO.

|

|

|

info'll need your unique Software ID which is provided in the software, during Learn how to If you're a tax or BAS agent you must notify If you don't notify the ATO using one of the notification confirmation options, the ATO will reject your reports. |

|

|

Yes Yes

Once you've notified the ATO that you're using MYOB

|

|

for payroll reporting for this business.software, click I've notified the ATO and in the confirmation message that appears, click Send. At the Transferring BMS ID step, select whether the business has reported via STP using other payroll software in the current payroll year. See the FAQ below for more info about this. | If the business | Do this |

|---|

| has NOT reported via STP in other payroll software in the current payroll year | - Select No.

- Click Next.

| | HAS reported via STP in other payroll software in the current payroll year | - Select Yes.

- Enter the Previous software BMS ID. For help finding this, see the FAQ below.

- Click Report previous BMS ID.

- When prompted to send your payroll information to the ATO, enter your details and click Send.

Transferring your BMS ID lets the ATO know you've changed payroll software, and moves your employee's year-to-date payroll amounts under your new BMS ID at the ATO end. If you haven't already, make sure you've entered your employee's pay history for the current payroll year into AccountRight. This ensures your employees' year-to-date pay amounts matches what you've reported via STP. |

|

|

info | You'll need your unique Software ID which is provided in the software, during this step. | Learn how to notify the ATO . | UI Text Box |

|---|

| What happens after I've |

connected to the ATO?Once you've connected to the ATO, you're all set up for Single Touch Payroll reporting. Your payroll information will be automatically sent to the ATO the next time you process payroll. You'll know you're set up when you see the following message in the Pay Period window (Payroll > Process Payroll).  Image Removed Image Removed

When you click Record to record a pay run, you'll be prompted to declare and submit the information to the ATO. You'll only be able to do this if you've completed the Connect to the ATO steps. If you started reporting before 1 July 2018 you'll still need to use the Payment Summary Assistant to produce payment summaries and send the Payment Summary Annual Report to the ATO (via the EMPDUPE file). You won't need to prepare or send payment summaries from the 2018/19 payroll year.

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What is my BMS ID and where do I find it? |

|---|

| What is my BMS ID and where do I find it?Each payroll software is identified using a Business Management Software (BMS) ID. When you set up STP, the ATO are notified of your BMS ID. If your business has previously reported via STP in the current payroll year using another MYOB or non-MYOB payroll software, when you set up STP in MYOB you must notify the ATO of the BMS ID of your previous software. Otherwise your employees' year-to-date (YTD) payroll information will be reported twice to the ATO, and no-one wants that...  Image Added Image Added

| UI Text Box |

|---|

| Transferring your BMS ID lets the ATO know you've changed payroll software, and moves your employee's year-to-date payroll amounts under your new BMS ID at the ATO end. If you haven't already, make sure you've entered your employee's pay history for the current payroll year into AccountRight. |

To find your previous BMS IDYou or your tax/BAS agent can find your previous BMS ID via the ATO's online services. - Log into the ATO's online services.

- Go to Employees > STP reporting (agents go to Business > STP reporting).

- Click the dropdown arrow next to one of your STP reports.

- Copy the Business Management software (BMS) ID so you can paste it into the Previous software BMS ID field in MYOB when prompted (see above).

Image Added Image Added

|

|

| HTML Wrap |

|---|

| width | 15% |

|---|

| class | col span_1_of_5 |

|---|

| | |

| HTML Wrap |

|---|

| float | left |

|---|

| class | col span_1_of_5 |

|---|

| | Panelbox |

|---|

| name | magenta |

|---|

| title | Related topics |

|---|

| |

| Panelbox |

|---|

| name | yellow |

|---|

| title | From the community |

|---|

| | RSS Feed |

|---|

| titleBar | false |

|---|

| max | 5 |

|---|

| showTitlesOnly | true |

|---|

| url | http://community.myob.com/myob/rss/search?q=pay+run&filter=labels%2Clocation%2CsolvedThreads&location=forum-board%3AEssentialsAccounting&nospellcheck=true&search_type=thread&solved=true |

|---|

|

|

|

|

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.