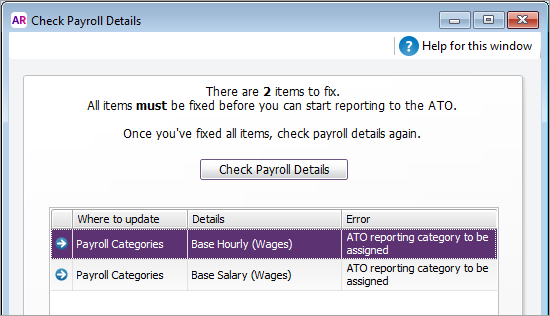

AccountRight Plus and Premier, Australia only When you set up Single Touch Payroll, your payroll information was checked to make sure it complied with the ATO's requirements. What gets checked? To ensure you stay compliant, AccountRight will check your payroll details each time you do a pay run. You'll be notified if any details are missing or invalid so you can fix it. You can also manually check your payroll details at any time (Payroll command centre > Payroll Reporting > Check Payroll Details).  Image Added Image Added

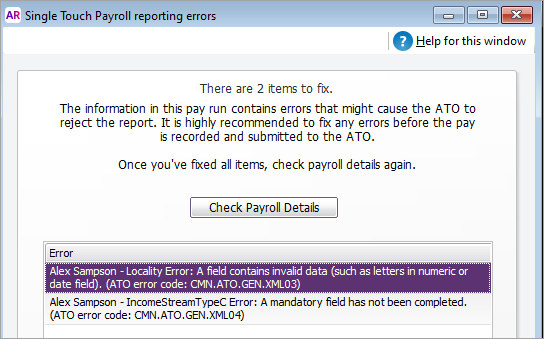

When you process your payroll, you might also see a similar warning, like this:  Image Added Image Added

| UI Text Box |

|---|

| The functions described on this page are available in AccountRight 2018.2 onwards. Get the latest version. |

Before reporting payroll and super information to the ATO, you need to check that your company information and employee details meet ATO requirements, and assign an ATO category to all your payroll categories. To do this, you can check your details in AccountRight and view a list of errors that need fixing. | Avoid headaches and penalties! If a payroll submission is rejected by the ATO due to missing or invalid details, you'll need to fix whatever caused the issue before the information can be accepted by the ATO. To avoid headaches like this, and any ATO penalties for late submissions, you should fix any identified issues before submitting your pay runs. |

| UI Expand |

|---|

| expanded | true |

|---|

| title | Check To fix issues in your payroll details |

|---|

| - Go to the Payroll command centre and click Payroll Reporting.

- Click Check Payroll Details. The Check Payroll Details window appears listing the results.

From this list you'll see what items you need to fix before you can connect to the ATO and start reporting using Single Touch Payroll.

| | UI Expand |

|---|

| expanded | true |

|---|

| title | Fix errors (if you have any) |

|---|

| Use the information in the results list as a guide to what you need to fix. | | Where to update | Do this... |

|---|

| Employee Cards | To fix information in an employee card, double click the employee in the errors list. The Card Information window appears.  Image Removed Image Removed

There are certain Employee details for Single Touch Payroll that must be entered before you can proceed. | | Company Information | To fix company information: - Go to the Payroll command centre and click Payroll Reporting.

- Click Company Information.

Image Removed Image Removed - Make the required fixes.

There are some company details that must be entered before you can proceed. | Payroll Categories | All payroll categories - Check the error description to see if it relates to your company information, an employee, or a payroll category.

- If there's a zoom arrow

Image Added next to the error, click it to open a window where you can fix the error. If there's no zoom arrow, check the error description has details about what needs fixing, e.g. an employee's address has the wrong information in a field. Image Added next to the error, click it to open a window where you can fix the error. If there's no zoom arrow, check the error description has details about what needs fixing, e.g. an employee's address has the wrong information in a field.

To fix:

- When you've fixed all the errors, click Check Payroll Details again. If there are no further errors, your payroll details are all good!

| UI Text Box |

|---|

| Need help understanding or fixing an issue? If you're not sure what an error means or how to fix it, we recommend speaking to the ATO or seeking advice from your accounting advisor. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | What if I don't have an employee's TFN? |

|---|

| What if I don't have an employee's TFN?You can use any of these TFNs provided by the ATO. - 111 111 111 for a new payee has not made a TFN declaration, (28 days have not passed).

- 333 333 333 for a payee under 18, earning less than $350 per week, $700 per fortnight or $1,517 per month.

- 444 444 444 for a payee who is an Australian Government pensioner payee.

- 000 000 000 if your payee chose not to quote a TFN and has not claimed an exemption from quoting a TFN or does not fit into any of the above categories.

Check with the ATO if you're unsure what to enter. |

| UI Expand |

|---|

| title | What payroll details are checked? |

|---|

| What payroll details are checked?When AccountRight checks your payroll details, the following fields are checked to make sure they meet the new STP requirements. | | What gets checked |

|---|

| Company information | - Company Name

- ABN

- ABN Branch (if you have one) what is this?

- Street Address

- Suburb/Town/City

- State

- Postcode

- Name (of contact person)

- Phone (of contact person)

You can access this information in AccountRight via Payroll > Payroll Reporting > Company Information. | | Employee details | Employees paid in the current and previous payroll year are included in the payroll check. Inactive employees are not checked. Here is the information that's required in your employee cards (accessed via Card File > Cards List > Employee tab > click an employee). On the Profile tab: - Last Name

- First Name

- Address

- Suburb/City

- State (you need to select a state from the list and not type it. If you have additional addresses (Address 2, etc.) ensure complete details are entered here too)

- Postcode

On the Payroll Details tab > Personal Details section: - Date of Birth

- Start Date

- Employment Basis

On the Payroll Details tab > Taxes section: - Tax File Number

Income Type

| UI Text Box |

|---|

| Do you employ working holiday makers? If you choose Working holiday maker as the Income Type, you'll also need to choose the worker's Country of origin. Also check that the correct Tax Table is assigned to working holiday makers based on your business's working holiday maker registration status. |

| | Payroll categories | Wage, deduction, and superannuation payroll categories used in the current and previous payroll year are included in the check. You can access your payroll categories in AccountRight via Payroll > Payroll Categories. Each of these must have an ATO reporting category assigned. By default, | the ATO category this is set to To be assigned, so you know what payroll categories still | have need assigning. How to assign | . There are certain rules for assigning | for Single Touch Payroll reporting. |

|

| UI Expand |

|---|

| expanded | true |

|---|

| title | Check payroll details again |

|---|

| You can click Check Payroll Details at anytime to refresh the list to see where you're up to. |

|