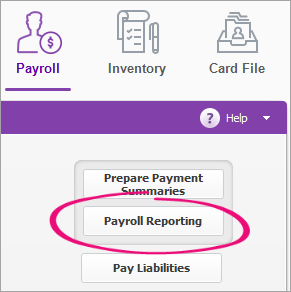

AccountRight Plus and Premier (v2018.2 and later), Australia only Single Touch Payroll (STP) is a simple way to report your employees’ payroll information to the ATO and keep your business compliant. Tell me more about STP. AccountRight helps you get STP ready—here's what's involved: Ready to get started?You'll need an internet connection to complete the setup, but your company file doesn't need to be online. You can dive right in by going to the Payroll command centre and clicking Payroll Reporting.

What you need to do- Check company and employee details meet ATO requirements.

- Assign ATO reporting categories to your payroll categories.

- Connect to the ATO to allow payroll info to be submitted.

| UI Text Box |

|---|

| Get your employees to set up a myGov account so they can access their year-to-date payroll info and end of year summary. |

| HTML |

|---|

<h2><i class="fa fa-comments"></i> FAQs</h2><br> |

| UI Expand |

|---|

| title | How do I know if I'm set up for STP? |

|---|

| How do I know if I'm set up for STP?You'll know you're set up when you see the following message in the Pay Period window when you start a pay run (Payroll > Process Payroll).

If the "Payroll reporting ready to go" message doesn't appear, you're either not your company file isn't set up for STP (see . See above for details ), or you need to add yourself as a declarer for STP reportingon getting set up. |

| UI Expand |

|---|

| title | What happens after I'm set up for STP? |

|---|

| What happens after I'm set up for STP?You'll continue processing your pays as normal, but after each pay run you'll be prompted to send the info to the ATO.

If this message doesn't appear after the pay run, you're either not your company file isn't set up for STP (see . See above for details ), or you need to add yourself as a declarer for STP reportingon getting set up. Learn more about what happens after setting up Single Touch Payroll. |

|