Luxury car tax (LCT) is payable by businesses that sell or import luxury cars (dealers), or individuals who import luxury cars.

LCT is calculated on cars with a GST inclusive value above the LCT threshold. Check the ATO website for the current LCT rate and threshold.

Ask an expert

LCT is a complex area likely to require expert help. For detailed information beyond what's provided in this topic, ask one of the experts on our community forum.

Registering for LCT

If your business sells luxury cars, you need to be registered for GST and LCT. For details on LCT registration check the ATO website.

When registered for LCT, labels 1E and 1F on your business activity statement (BAS) will be used for paying LCT or making LCT adjustments. Learn about setting up and preparing activity statements.

LCT in AccountRight

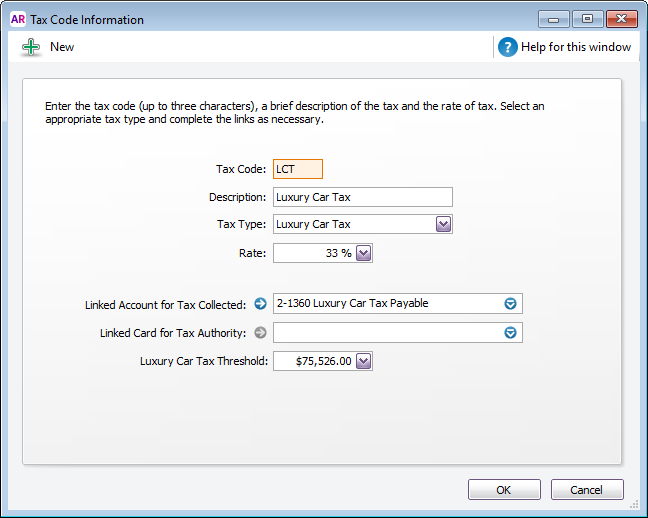

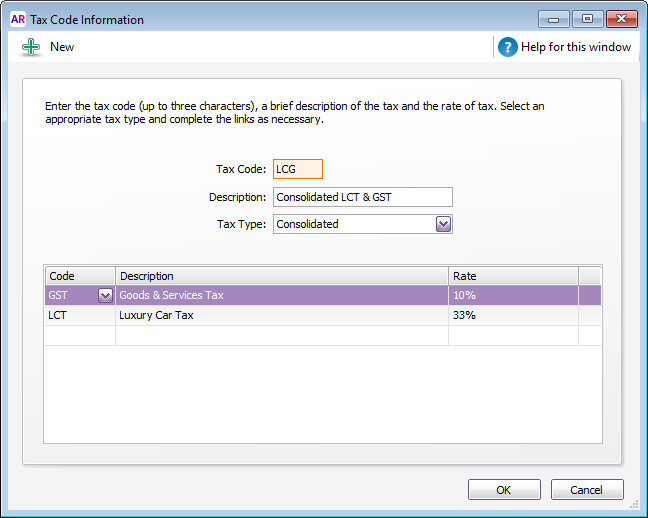

AccountRight comes with 2 default tax codes for luxury car tax: LCT and LCG. Because rates and thresholds change, you should check the setup of these tax codes before using them (Lists menu > Tax Codes > click the zoom arrow to open a tax code).

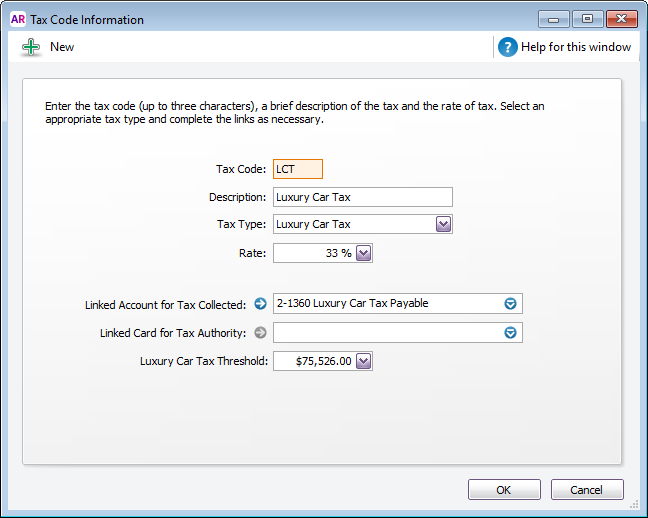

LCT: This tax code contains the LCT rate and threshold (check the ATO website for current LCT rate and threshold). This tax code is also where you specify your linked account for tax collected. Check with your acounting advisor if you're not sure which account to use.

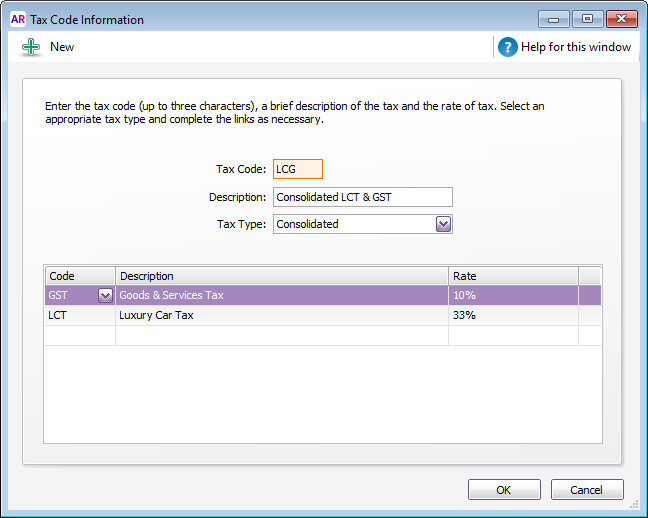

LCG: This is a consolidated tax code which combines GST and LCT. When used on a sale, GST is calculated on all values and LCT is calculated on values above the LCT threshold.

To enter an invoice with LCT

Example

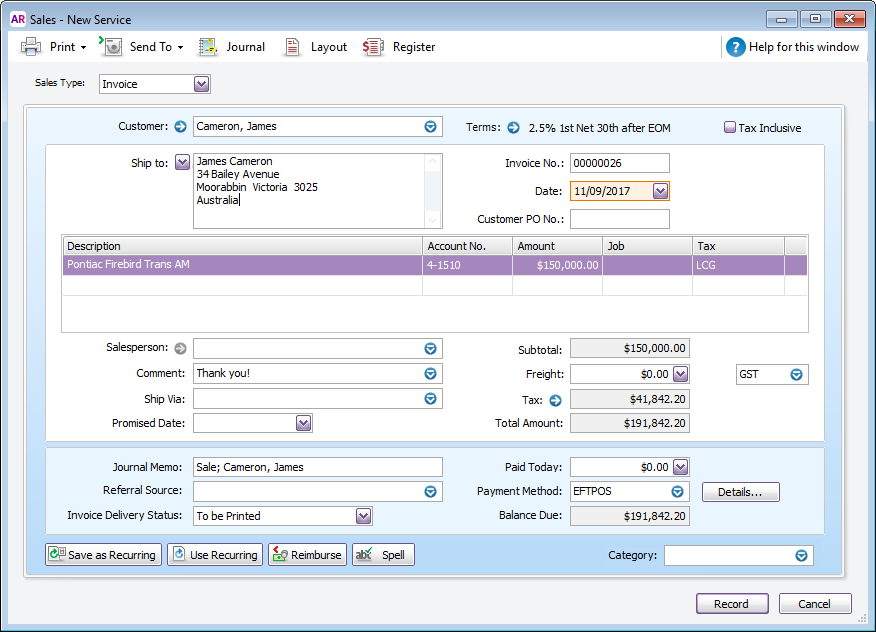

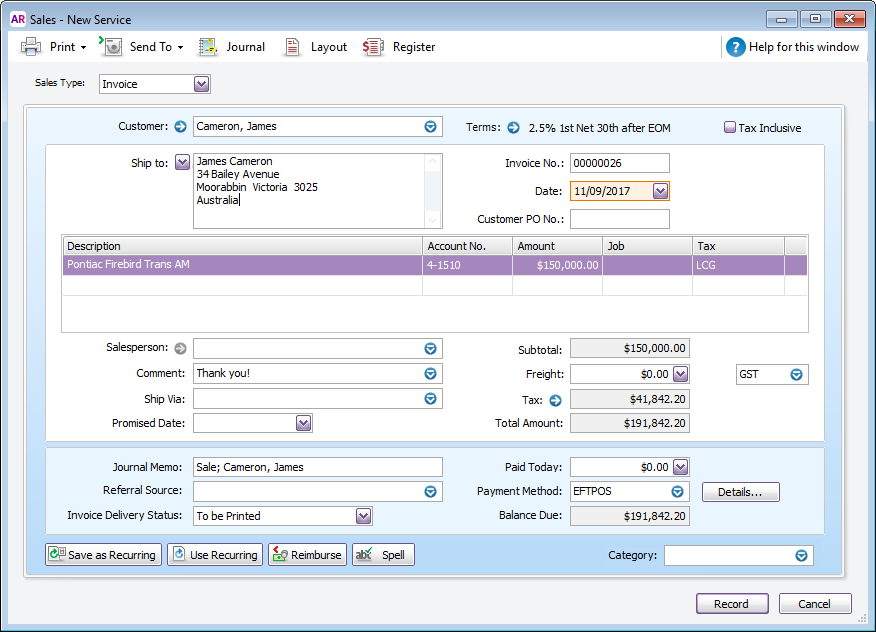

XYZ Company sells a car to a customer worth $150,000 (GST exclusive value). This means the LCT value of the car is $165,000 ($150,000 + 10% GST).

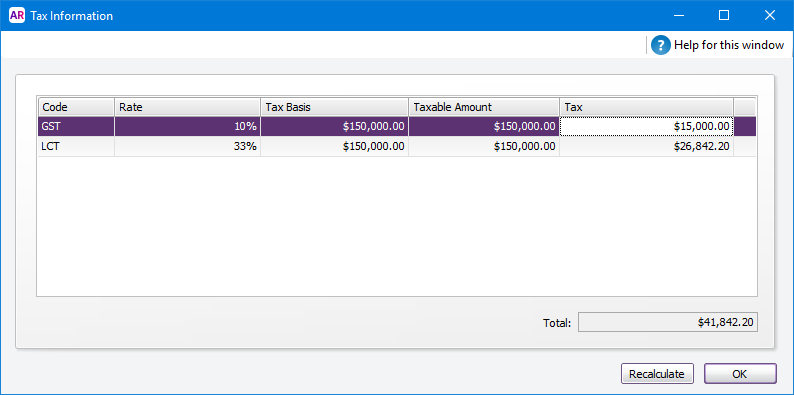

To check the software's calculation, use the formula given above:

33/100 x 10/11 x ($165,000 - $75,526) = $26,842.20 LCT

Add the LCT to the GST inclusive price to give the amount payable for the car. In our example this is:

$165,000 + $26,842.20 = $191,842.20

When entering the details on the invoice, deselect the Tax Inclusive option and use the consolidated tax code LCG. Here's our example:

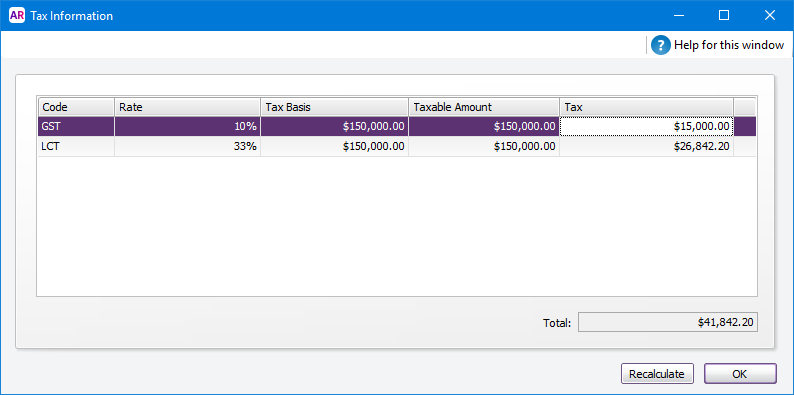

Clicking the zoom arrow beside the Tax amount on the invoice shows the calculated GST and LCT values.

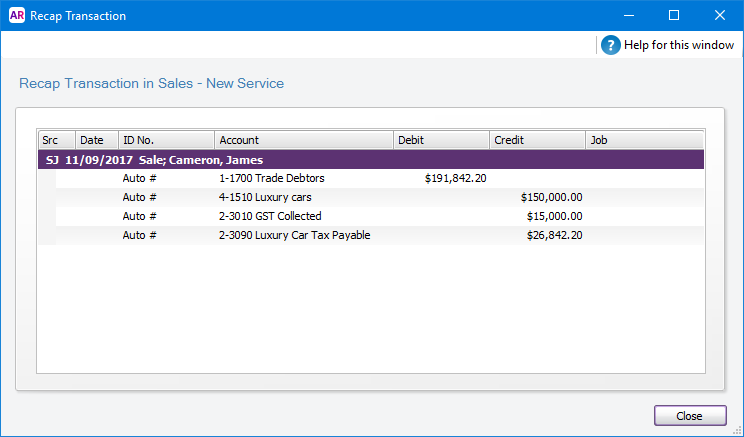

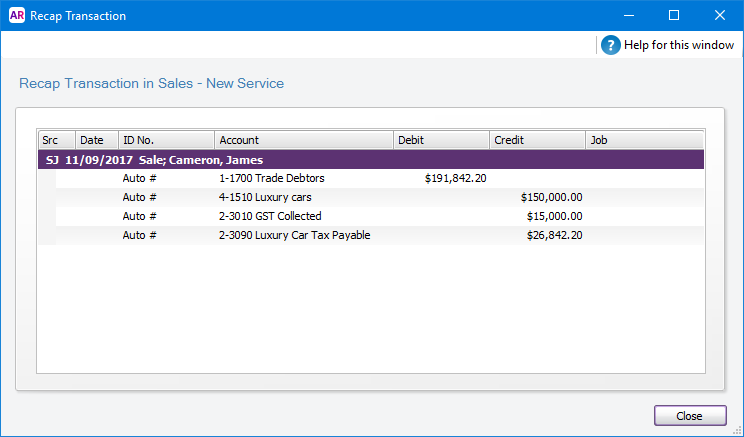

If you go to the Edit menu and choose Recap Transaction, the amounts going to each account can be seen:

XYZ Company would include $15,000 GST and $26,842.20 LCT on their Business Activity Statement (BAS). Note that unlike GST, no input tax credit is available for LCT, regardless of whether the luxury car is used within the business or for private purposes.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.