- Created by MichelleQ, last modified by RonT on May 27, 2020

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 34 Next »

https://help.myob.com/wiki/x/FYBsB

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

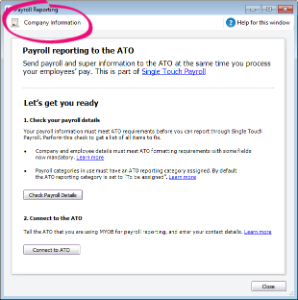

When setting up Single Touch Payroll, you'll need to check your payroll details. This identifies any company information that need updating. What gets checked?

Here's what to do:

- If you're not already on the Check Payroll Details window (shown above), go to the Payroll command centre and click Payroll Reporting.

- Click Check Payroll Details. The Check Payroll Details window appears listing the results. If you receive no errors continue with Task 2 - Connect to the ATO for Single Touch Payroll reporting.

Click the arrow next to the company information error in the list (see example above). The Company Information window appears. You can also get to this window via the Payroll command centre > Payroll Reporting > Company Information.

Make the required fixes. Do you have an overseas address?

Check your ABN

The ABN you enter here is what is sent to the ATO each time you process payroll. Ensure the ABN is your current ABN and doesn't have any typos.

This ABN must match what is entered when you Connect to the ATO. If they don't match, the payroll reports will be rejected and not sent to the ATO.

- Click OK to save your changes and return to the Payroll Reporting window.

- Click Check Payroll Details to refresh the list to see if everything is done. If everything is fine, you're ready to Connect to the ATO.

FAQs

What payroll details are checked during STP setup?

When you click Check Payroll Details during STP setup, the following is checked for missing or invalid information.

| What gets checked | |

|---|---|

| Company information | The company information is based on your previous year's Payment Summary information, but you can enter different details if required. You can always change this information at any time. The required fields are:

You can access this information via Payroll > Payroll Reporting > Company Information.

|

| Employee details | Employees paid in the current payroll year (including terminated employees) are included in the payroll check. Inactive employees are not checked. The required employee information is:

|

| Payroll categories | Wage, deduction and superannuation payroll categories used in the current payroll year are included in the check. Each of these must have an ATO reporting category assigned. By default, this is set to To be assigned , so you know what payroll categories still need assigning.

|

What if I have an overseas address?

If your company is a non-resident and has an overseas address, enter OTH in the State field:

- The Country field is activated. You must enter your company's country information in this field.

- The Postcode field defaults to 9999 and cannot be changed.

- The state and postcode as well as the town must all be reported in the Suburb/Town/City field.

For example, assume your address is 275 Central Park West, Apartment 14F, New York, NY USA 10024. This address would be entered as follows:

Street Address - Line 1: 275 Central Park West

Street Address - Line 2: Apartment 14F

Suburb/Town/City: New York, NY 10024

State: OTH

Postcode: 9999

Country: USA

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.