- Created by MichelleQ, last modified by AdrianC on Jul 08, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 96 Next »

https://help.myob.com/wiki/x/WQAFBQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

If a report you've submitted to the ATO has a Rejected status, view the error details to find the error code. Then check the list of errors below for a solution.

The Rejected status will remain for the report, but once you've fixed the issue, updated payroll information will be sent to the ATO after the following pay run, or you can send an update event as described in the FAQs below.

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in with your MYOB account details (email address and password).

- In the list of reports, click the Pay period of the rejected report you want to view. You'll see details of why the report was rejected.

- Find the error code, then see below for a solution.

SBR.GEN.AUTH.006

You'll get this error if you haven't notified the ATO you're using MYOB for payroll reporting.

If you haven't notified the ATO...

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the ATO settings tab.

- Note down your Software ID.

- Notify the ATO you're using MYOB for payroll reporting by either:

- phoning the ATO on 1300 852 232, or

- using Access Manager to notify the ATO of a hosted SBR software service.

If you have notified the ATO...

Check your ATO settings and update Single Touch Payroll details if necessary.

- Go to the Payroll command centre and click Payroll reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in with your MYOB account details.

- Click the ATO settings tab.

- Check the ABN.

- If the ABN is incorrect click Edit STP business details (near the bottom of the screen).

- Follow the prompts to set up Single Touch Payroll again.

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

If the issue persists, get in touch with our support team.

SBR.GEN.AUTH.008

You'll get this error if you've notified the ATO of the wrong Software ID.

To get your Software ID and notify the ATO:

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the ATO settings tab.

- Note down your Software ID.

- Notify the ATO you're using MYOB for payroll reporting by either:

- phoning the ATO on 1300 852 232, or

- using Access Manager to notify the ATO of a hosted SBR software service.

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

If the issue persists, get in touch with our support team.

CMN.ATO.AUTH.007

There are a couple of reasons why you might be getting this error. Usually, it's because there is a mismatch of data between the ATO and MYOB systems.

In Access Manager...

Make sure the tax or BAS agent has permission to lodge payroll reports.

Confirm you've notified the ATO that the business is using MYOB for payroll reporting.

In the tax or BAS agent portal...

Make sure the client is in your client list.

Confirm the client's details are correct (ABN, TFN and ABN branch number), and that they match what's in MYOB.

In MYOB...

Get in touch with our support team.

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

CMN.ATO.AUTH.008

This error means you're not authorised to submit this lodgment on behalf of this client. There are a few things you can do:

- If you're a tax agent, use your registered agent number and try to lodge again.

- If you're a business sending on behalf of another business, get an Authorisation administrator to make sure there's a business appointment in Access Manager and provide your credentials if required.

- If the client is on your client list and is not a restricted client, you may need to remove them from the list, then re-add them before you try to lodge again.

You also need to make sure your agent number is linked to the correct agent ABN in Access Manager.

CMN.ATO.AUTH.011

This error will only be for Tax or BAS agents. It means the client you reported is not associated with the Agent ABN or Registered Agent Number you supplied when you set up STP.

CMN.ATO.GEN.200001

What causes this error?

This typically is to do with an ABN being incorrectly entered during the Connect to ATO process. This may be because:

- you've entered your agent ABN instead of the business's ABN

- you've entered in the wrong ABN

- the ABN entered during the Connect to ATO process doesn't match what's in your company information (Payroll command centre > Payroll Reporting > Company Information).

How to resolve this error

| Things to check | Steps |

|---|---|

| Check the ABN you entered in Company information, matches what was entered during Connect to ATO process. | If the ABN in Company information is incorrect

The correct YTD amounts will sent to the ATO next pay run. If the ABN you entered during the Connect to the ATO process is incorrect

Make sure you have your ABN details handy. Both ABNs match and are correctMove to the next step. |

| What Software ID did you provide when notifying the ATO you are using MYOB for payroll reporting | Someone else gave me the Software ID (eg tax or BAS agent)Each Software ID is unique to the current user. You must get the Software ID from MYOB, while logged in to your own account.

The correct YTD amounts will sent to the ATO next pay run. I think I used the Software ID from MYOB, logged in as meYou can check this.

The Software ID I provided to the ATO was correct

|

Once the error is fixed the details will be sent when you process your next pay run, or you can send an update event as described in the FAQs below.

CMN.ATO.GEN.XML03

This error means there's an invalid character somewhere in your in your payroll information in MYOB. Invalid characters are "[ ] ! # $ % * ; = @ <>\ _ { } ^~`"

You'll need to check for (and remove) any invalid characters in your employee cards and payroll category names.

To check your employee cards

- Go to the Card File command centre > Cards List.

- Click the Employee tab.

- Click the blue zoom

arrow to open an employee's card.

arrow to open an employee's card. - On the Profile tab, check the following fields and remove any invalid characters:

- Last Name

- First Name

- Address

- Suburb/City

- Postcode (if the correct postcode only has 3 digits, enter a zero at the start)

- On the Payroll Details tab > Taxes section, check the Tax File Number field and remove any invalid characters.

- Click OK if you've made any changes.

- Repeat for each of your employees.

To check your payroll category names

- Go to the Payroll menu > Payroll Categories.

- Repeat the following steps on each payroll category on the Wages, Superannuation and Deductions tabs:

- Click the blue zoom

arrow to open a payroll category.

arrow to open a payroll category. - Check the Name field and remove any invalid characters.

- Click OK if you've made any changes.

- Click the blue zoom

Once you've removed any invalid characters, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send updated information to the ATO at any time as described in the FAQs below.

CMN.ATO.PAYEVNTEMP.000389

This error means the pay run hasn't successfully sent to the ATO. But you can easily send it from the Single Touch Payroll reporting centre.

To send the report to the ATO

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Send the report to the ATO (it'll have a status of Not sent)

- If you're reporting via STP Phase 2, click the report then click Send to ATO.

- If you're reporting via STP Phase 1, click the elipses

button for the report and choose Send to ATO.

button for the report and choose Send to ATO.

- Enter your details into the declaration and click Send.

CMN.ATO.PAYEVNT.EM99507

This error means there is an issue with the previous BMS ID that you transferred to the ATO when you set up STP in AccountRight.

What's a previous BMS ID?

Each payroll software is identified using a Business Management Software (BMS) ID. If you previously reported via STP in the current payroll year using different payroll software, when you set up STP in AccountRight you need to transfer the BMS ID of your previous payroll software.

This error will occur if:

- you transferred the wrong previous BMS ID, or

- you transferred a previous BMS ID when you didn't need to (you only need to transfer a previous BMS ID if you've reported via STP in the current payroll year in other payroll software, before moving to AccountRight).

How you fix this error depends on your scenario:

OK, this means you'll need to find your correct previous BMS ID, then set up STP again in MYOB to enter this BMS ID.

To find your previous BMS ID

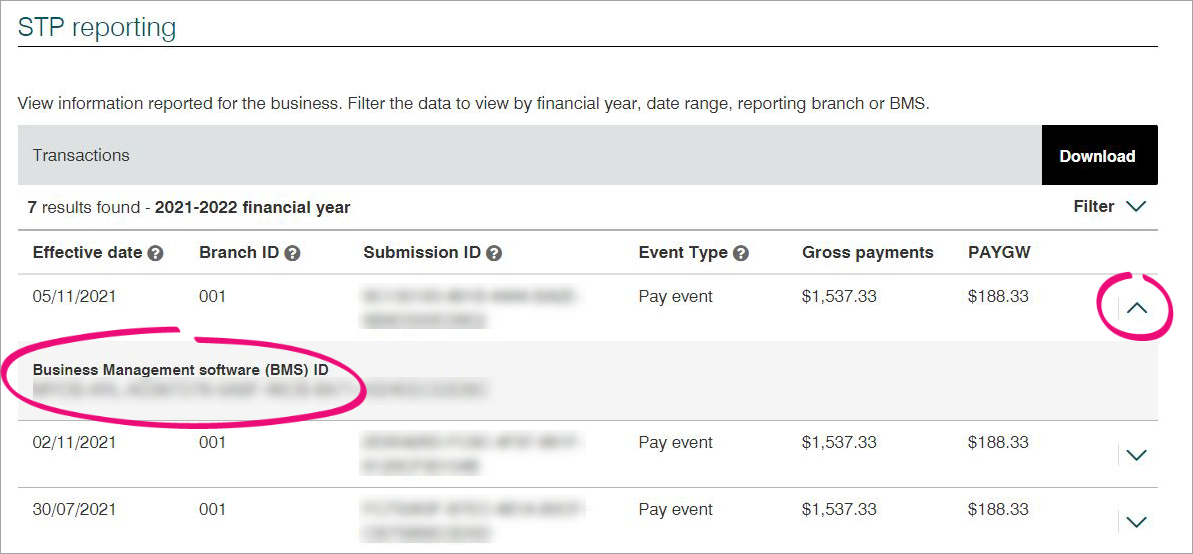

You or your tax/BAS agent can find your previous BMS ID via the ATO's online services.

- Log into the ATO's online services.

- Go to Employees > STP reporting (agents go to Business > STP reporting).

- Click the dropdown arrow next to one of your STP reports.

- Copy the Business Management software (BMS) ID so you can paste it into the Previous softwareBMS ID field in MYOB when prompted (see above).

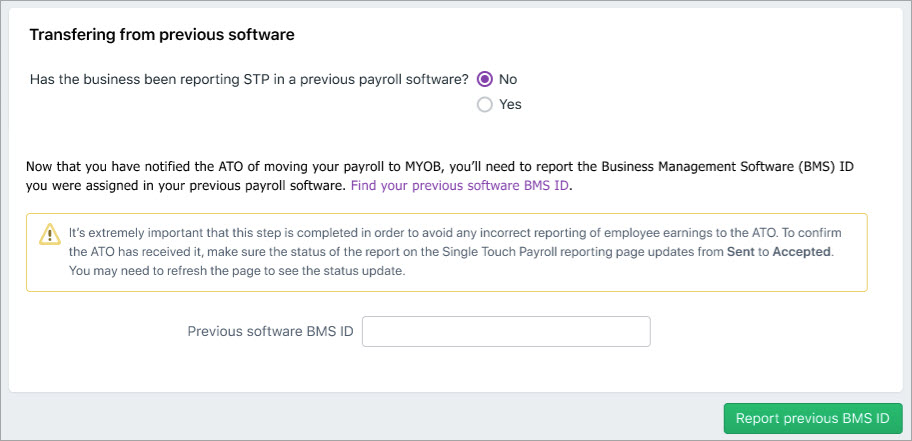

To set up STP again in AccountRight

- Go to the Payroll command centre and click Payroll reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in with your MYOB account details.

- Click the ATO settings tab.

- Click Edit STP business details (near the bottom of the screen).

- Follow the prompts to set up STP again.

- At the Transferring BMS ID step, select Yes and enter the Previous software BMS ID you found in the task above.

- Click Report previous BMS ID and complete the STP setup.

Once you've set up STP again, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send updated information to the ATO at any time as described in the FAQs below.

OK, you just need to set up STP again in AccountRight, and select No when prompted for a previous BMS ID.

- Go to the Payroll command centre and click Payroll reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in with your MYOB account details.

- Click the ATO settings tab.

- Click Edit STP business details (near the bottom of the screen).

- Follow the prompts to set up STP again.

- At the Transferring BMS ID step, select No and click Report previous BMS ID.

Once you've set up STP again, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send updated information to the ATO at any time as described in the FAQs below.

Most rejection errors are generated by the ATO, so check the ATO website for more details.

Can't find your error? Get in touch with our support team.

Need to fix a pay? See Changing a recorded pay.

FAQs

How do I resend a rejected report to the ATO?

You can't resend a rejected report and the Rejected status will remain for the report in the Payroll Reporting Centre.

Once you've fixed whatever caused the report to be rejected, the employee's latest year-to-date payroll information will be sent to the ATO after you process their next pay run.

Alternatively, you can send an update event to the ATO as described in the FAQ below.

How do I send an update event to the ATO?

An update event is where you send your employees' latest year to date payroll totals to the ATO. This ensures your payroll totals in MYOB sync with the figures held by the ATO.

If you're reporting via STP Phase 2, you can send an update event from the STP reporting centre. Otherwise you'll need to record a zero dollar ($0) pay for each employee whose year to data payroll totals you want to send to the ATO.

Am I reporting via STP Phase 2?

If you're on STP Phase 2, you'll see the Send update event button in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this button, you're on STP Phase 1.

- Go to the Payroll command centre and click Payroll Reporting.

- Click Payroll Reporting Centre.

- If prompted, sign in using your MYOB account details (email address and password).

- Click the STP reports tab.

- Choose the applicable Payroll year.

- Click Send update event.

- When prompted, enter your details and click Send.

You can send an update event for your employees by recording a $0 pay for them. This type of pay is also called a void pay and it's like any other pay, but all hours and amounts will be zero.

When you record a $0 pay, the employee's latest year to date payroll totals will be sent to the ATO.

- Start a new pay run (Payroll > Process Payroll). Need a refresher?

- Select the option Process all employees paid and choose Bonus/Commission. Ignore the displayed warning – we're choosing this option to ensure all hours and amounts are removed from the pays.

- Ensure the Payment Date is in the payroll year you're sending the update event for.

- Select the employees you want to send the update for. If unsure, select them all.

- Because you chose Bonus/Commission at step 2, you'll notice all hours and amounts are removed from each employee's pay (which is just what we want). Here's an example.

- Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

What information is sent to the ATO?

Only your employees' year to date figures are sent to the ATO. So each time you process a pay run, your employees' latest year to date figures are sent to the ATO

How do I fix or delete a report that's been sent to the ATO?

You can't delete or "undo" a report that's been sent to the ATO. Instead, you'll need to reverse or delete the incorrect pay, record it again and submit it to the ATO.

Can I resend a report to the ATO after I've fixed it?

No, you can't resend, delete, or undo rejected reports in the ATP reporting centre. The Rejected status will remain for the report. But once you've fixed the issue (maybe you need to change a pay), updated payroll information will be sent to the ATO on the following pay run.

What's a pay event and an update event?

Pay runs submitted to the ATO are either pay events or update events.

A pay event can only occur in the current payroll year, and will contain a dollar value. A regular pay run is considered a pay event, where both employee and employer year-to-date totals are submitted to the ATO.

An update event can only occur in the current payroll year, but it won't contain a dollar value. For example, if you change a paid amount from one payroll category to another—like changing a $20 bonus to a $20 commission. The pay amount won't change, but the details will. For update events, only the employee's year-to-date totals are sent to the ATO, but not the employer's year-to-date totals. See the FAQ above about sending an update event.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.