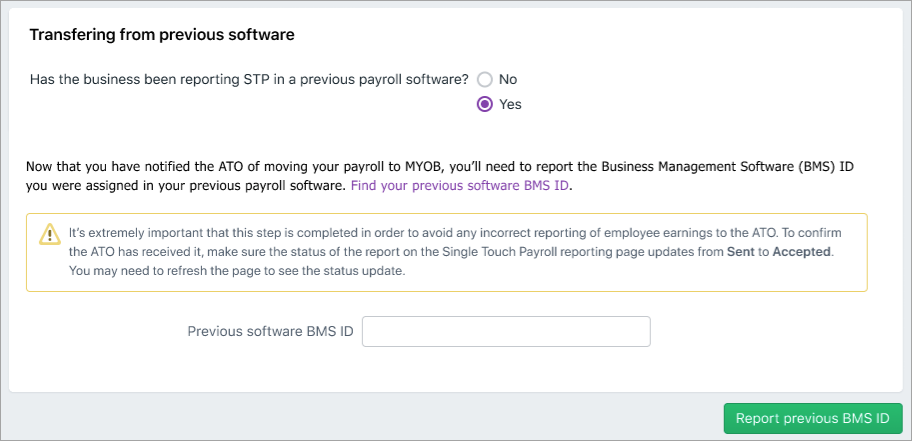

What is my BMS ID and where do I find it?Each payroll software is identified using a Business Management Software (BMS) ID. When you set up STP, the ATO are notified of your BMS ID. If your business has previously reported via STP in the current payroll year using another MYOB or non-MYOB payroll software, when you set up STP in MYOB you must notify the ATO of the BMS ID of your previous software. Otherwise your employees' year-to-date (YTD) payroll information will be reported twice to the ATO, and no-one wants that...  Image Added Image Added

| UI Text Box |

|---|

| Transferring your BMS ID lets the ATO know you've changed payroll software, and moves your employee's year-to-date payroll amounts under your new BMS ID at the ATO end. If you haven't already, make sure you've entered your employee's pay history for the current payroll year into AccountRight. |

To find your previous BMS IDYou or your tax/BAS agent can find your previous BMS ID via the ATO's online services. - Log into the ATO's online services.

- Go to Employees > STP reporting (agents go to Business > STP reporting).

- Click the dropdown arrow next to one of your STP reports.

- Copy the Business Management software (BMS) ID so you can paste it into the Previous software BMS ID field in MYOB when prompted (see above).

Image Added Image Added

|