You are viewing an old version of this page. View the current version.

Compare with Current View Page History

Version 1 Next »

https://help.myob.com/wiki/x/jpQHAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

Australia only

From 1 January 2017, tax rates changed for working holiday makers who are in Australia on a 417 or 462 visa (the 'backpacker tax').

Under this new tax scale, you should withhold 15% from every dollar earned by a working holiday maker up to $37,000 with foreign resident tax rates applying from $37,001. See the ATO for more details.

You should start withholding at these rates from the first pay run after 1 January 2017.

Registering with the ATO

If you currently employ, or are likely to employ working holiday makers, you must register by 31 January 2017 to avoid penalties. Register from the ATO website

How to withhold the working holiday maker tax

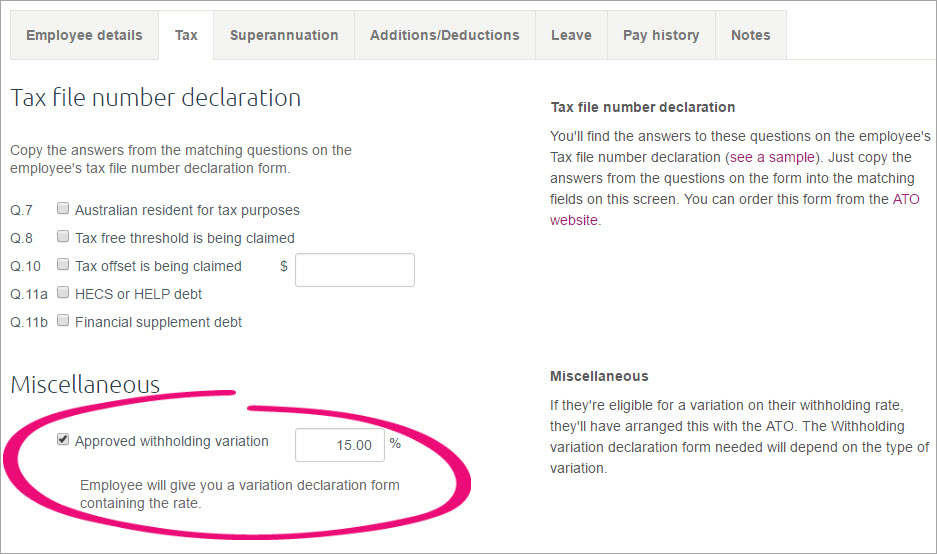

You can use the Approved withholding variation function in MYOB Essentials to withhold the correct percentage.

Already paid working holiday makers in 2016? If you're already paid a working holiday maker in 2016 and will continue paying them in 2017, you'll need to add them as a new employee in 2017 to ensure two payment summaries are accurately produced.

Setting up a new employee profile

If you paid working holiday makers in 2016 who will be paid with the new tax rate in 2017, you need to issue two payment summaries:

- July 1 - December 31 2016

- January 1 - June 30 2017

For MYOB Essentials to issue two payment summaries for a working holiday maker, you'll need to set a Finish date on their current employee profile and create a new employee profile for the working holiday maker.

Here's how to do it:

- Enter a Finish date in the working holiday maker's employee details.

- Go to Payroll > Employees and click on the working holiday maker's name to open their Employee details.

- In the Finish date field, enter 31/12/2016.

- You can use the Notes tab to enter something to identify this as the 2016 employee profile.

- Click Save.

- Add your working holiday maker as a new employee.

- Go to Payroll > Employees and click the Add Employee button.

- Enter the same employee details from the original profile. On the Employee details tab, enter a Start date of 01/01/2017.

- You can use the Notes tab to enter something to identify this as the 2017 employee profile.

- Go to the Tax tab, and set a 15% Approved withholding variation as described in the next task, Setting a withholding variation.

- Click Save. You can now use this employee profile when paying the employee from their first pay in 2017.

When you produce PAYG payment summaries at the end of the financial year, two summaries will be created for the working holiday maker.

Setting a withholding variation

- Go to the Employees screen (Payroll > Employees) and click the name of a working holiday maker.

- Go to the Tax tab.

- Check the box for Approved withholding variation, and enter the correct withholding rate (i.e., 15% for working holiday makers earning $0-37,000).

- Click Save.

Repeat these steps for each working holiday maker you employ. When you're finished, you're ready to do a payrun.

Important: You should manually track your working holiday makers' gross earnings to confirm their correct tax rates. You can do this by checking their pay history.

FAQs

What happens if I don't register for the working holiday maker tax?

If you don't register for the working holiday maker tax, you must withhold the foreign resident tax rate of 32.5% for working holiday makers. Follow the steps in Setting a withholding variation to set this rate.

If you withhold 15% for working holiday makers without registering, you may be penalised by the ATO.

What if a working holiday maker hasn't provided their tax file number (TFN)?

You must withhold 47% from payments to working holiday makers if:

- They have not provided you with their tax file number (TFN),

- have not claimed an exemption from quoting their TFN, or

- have not advised that they have applied for a TFN.

Why do I need to issue two payment summaries for working holiday makers paid in 2016?

Working holiday makers who earned income between 1 July and 31 December 2016 and continue earning income up to 30 June 2017 will require two payment summaries. This is an ATO requirement because the tax change introduces two separate rates of taxation within the same financial year.

You can set up a new employee profile as described above to allow Essentials to generate two payment summaries for working holiday makers. One payment summary will be for the period 1 July - 31 December 2016, and the second payment summary will be for 1 January - 30 June 2017.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.