You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 13 Next »

https://help.myob.com/wiki/x/roJs

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

There are different types of superannuation your employees might be entitled to, including

- Superannuation guarantee

- Salary sacrificed superannuation

- Additional super payments

Depending on the type of superannuation, the amount will be paid in addition to their pay (an employer expense), or deducted from their pay (a deduction). Either way, you track the amounts that are calculated using superannuation payroll categories.

Go to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears.

- Click the Superannuation tab.

- Click New. The Superannuation Information window appears.

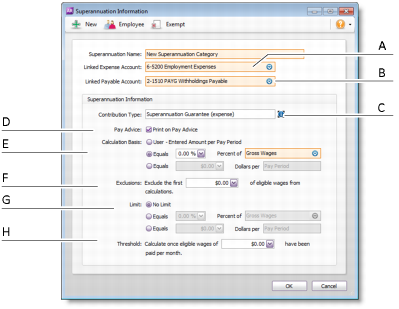

Type a name for the superannuation category and make the required selections in the window.

A Linked Expense Account is the account to which you charge employer expense superannuation payroll categories (Employer Additional, Productivity Superannuation, Redundancy Superannuation or Superannuation Guarantee). The Default Employer Expense Account you specified when setting up payroll appears as the default.

We recommend you create an expense account called Superannuation Expense and select it as the linked expense account.

B Linked Payable Account is the liability account to which the superannuation amounts accrue. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default.

We recommend you create a liability account called Superannuation Liability and select it as the linked payable account.

C The Contribution Type may be Employee Additional, Employer Additional, Productivity, Redundancy, Salary Sacrifice, Spouse or Superannuation Guarantee. Select the appropriate type from the list.

- The Salary Sacrifice (deduction) contribution type is deducted from an employee’s gross pay, that is, before PAYG withholding tax is calculated. It reduces the employee’s gross taxable income.

- The Employee Additional (deduction) and Spouse (deduction) contribution types are deducted from the employee’s net pay, that is, after PAYG withholding tax is calculated.

- The Employer Additional (expense), Productivity (expense), Redundancy (expense) and Superannuation Guarantee (expense) contribution types are paid in addition to the employee’s gross pay.

D If you want the superannuation amount accrued to appear on employees’ pay advice, select the Print on Pay Advice option. E Calculation Basis can be:

- User-Entered Amount per Pay Period allows you to enter an amount at the time the pay is processed each pay period. Choose this option if the amount varies regularly or if you want to use the amount you have entered in an employee’s standard pay details.

- Equals x Percent of allows you to enter a percentage of a payroll category (such as wage, deduction or superannuation) or a percentage of all wage categories (by choosing Gross Wages or Federal Wages ). The superannuation will be calculated until the limit is reached.

- Equals x Dollars per allows you to enter a specified amount per pay period, per hour, per month or per year until the specified limit is reached.

F In the Exclusions field type the amount by which the eligible wage is reduced before the superannuation is calculated. For example, an employee with a gross wage of $1000 per month and an exclusion of $100 will have the superannuation calculated only on $900.

G Superannuation limits can be used to place a ceiling on the superannuation calculation. For example, for an Employee Additional superannuation deduction of $30 per pay period and a limit of 2% of gross wages, a pay with gross wages of $1000 yields superannuation of only $20 (i.e. 2%). Limit can be one of the following three choices:

- No Limit signifies no limit to the superannuation calculated for this category.

- Equals x Percent of results in the maximum superannuation calculated being a percentage of wage, deduction or superannuation payroll categories. For example, an Employer Additional superannuation contribution might be $20 per pay period, but this should not exceed a maximum of 20% of the employee’s base salary.

- Equals x Dollars per results in the maximum superannuation calculated being a fixed amount per pay period, per hour, per month or per year. For example, a Salary Sacrifice superannuation might be 5% of the employee’s gross wages up to $1000 per year.

H If this superannuation calculation is only payable if wages exceed a specified amount per month (such as for superannuation guarantee contributions), enter this amount in the Threshold field. For example, if the threshold is $450 per month, then superannuation is not payable until the employee’s gross wage exceeds $450 per month. When determining whether the gross wages on a pay exceeds the threshold per month, other pays issued that month are included. (See also Troubleshooting superannuation calculations.) - Click Employee. The Linked Employees window appears.

- Select the employees whose pay will include this category, then click OK.

- Click Exempt. The Exemptions window appears for the payroll category you are creating.

- Select the taxes and deductions that do not apply to the new category.

- Click OK and click OK again to return to the Payroll Category List window.

You'll need to pass on the super amounts that are calculated and deducted to each employee's chosen superannuation fund. To help you track the amounts to pay to each fund, set up superannuation funds.

Reportable Employer Super Contributions (RESC)

The ATO requires that some superannuation contributions that exceed the superannuation guarantee amount (for example, salary sacrifice and some salary packaged amounts), be reported on payment summaries. These reportable contributions need be set up as separate superannuation payroll categories, so that they are easily reported when preparing payment summaries and the electronic EMPDUPE file you send to the ATO.

When you prepare payment summaries, you need to select the superannuation payroll categories that are reportable (this does not include superannuation guarantee categories).

For detailed information about Reportable Employer Super Contributions, contact the ATO or your accountant.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.