- Created by BrianQ, last modified by RonT on Oct 10, 2018

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 107 Next »

https://help.myob.com/wiki/x/9jnnAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

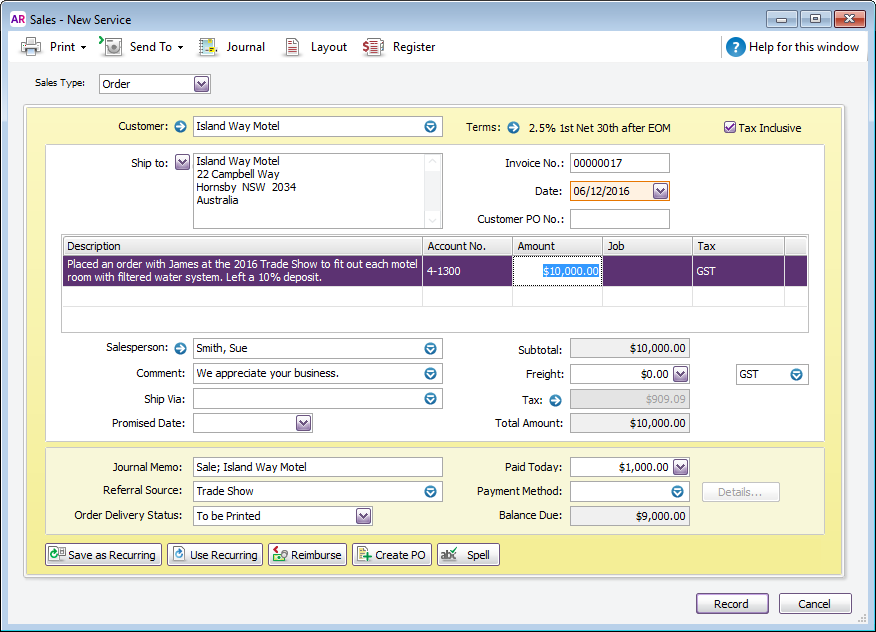

Made a sale? Great, now you can record the quote, order or invoice in AccountRight. And don't worry, if you make a mistake (like missing a line or entering the wrong amount), you can edit the sale later (so long as your security settings allow it). You can also personalise the forms you print and email.

Want to invoice using your smartphone? If your company file is online, try MYOB Invoices - it's a free iOS and Android app that works great with your AccountRight software. Learn how to get started with MYOB Invoices.

To enter a sale

- Go to the Sales command centre and click Enter Sales.

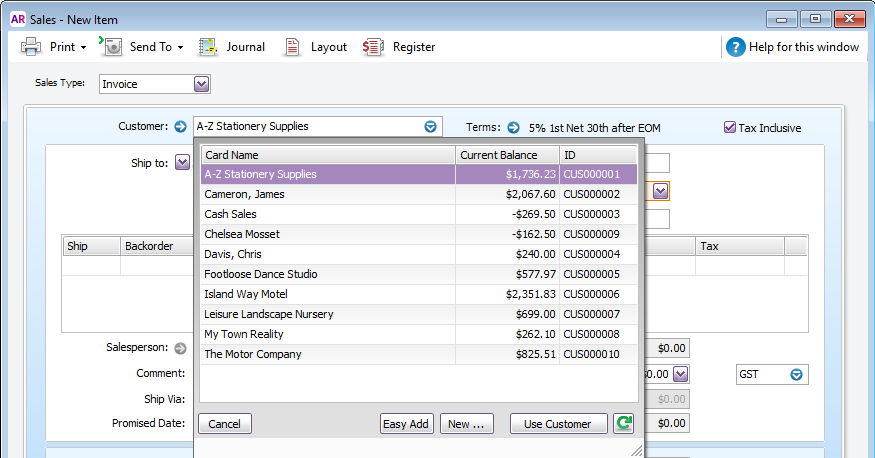

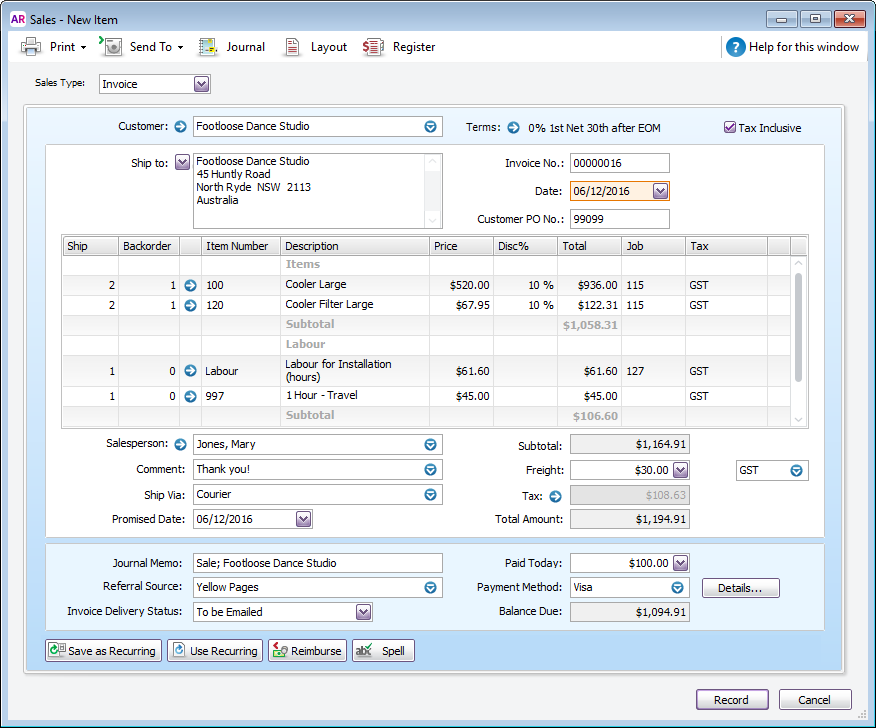

Select the customer, or add a card for them. Note that you can't change the card once you've recorded the sale, so make sure you select the correct card.

If you've set up additional addresses in the customer's card, you can click the dropdown arrow next to the Ship to field to select a different address.

Are the credit terms right? Click the Terms arrow to change the customer's default credit terms for this sale only.

Are the credit terms right? Click the Terms arrow to change the customer's default credit terms for this sale only.If you're entering prices that include tax or GST, select the Tax Inclusive (Australia) or GST Inclusive (New Zealand) option. The selection you make here will be remembered for your next sale. Don't change this setting after you start entering amounts.

The Invoice No. field shows the next available number for your invoices, quotes and orders. If you click the Invoice No. field, Auto # appears to confirm that the number has been automatically selected for you. You can type a different number into the field if you want. Subsequent invoice numbers will then increment from the new number. If your invoice number includes letters, the letters won't automatically appear in subsequent invoice numbers (you'll need to enter these each time).

You might want to use the preferences below to have more control over your invoice numbers.

- to prevent duplicate invoice numbers being used (Setup > Preferences > Sales> Warn for Duplicate...Numbers on Recorded Sales).

- to keep the same invoice number when converting a quote or order to an invoice (Setup > Preferences > Sales> Retain Original Invoice Number when Quotes Change to Orders or Invoices).

Type or select the invoice date. By default, the date will be today's date, unless you have previously changed it. If you do change the invoice date, it will be retained for that session each time you enter an invoice.

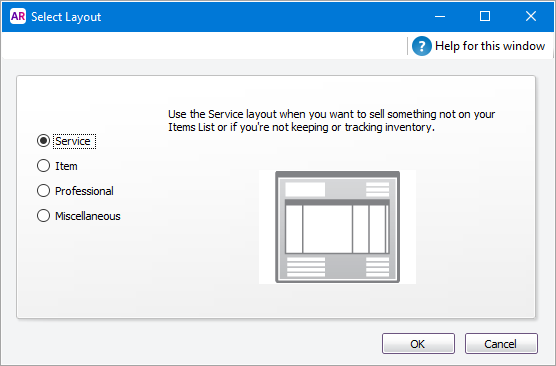

Want to change the sale layout to suit the type of goods or services you're providing? Click Layout. Note that sales using the Miscellaneous layout can't be printed or emailed.

Set a default sale layout

Use the Sales Easy Setup Assistant to set a default sale layout for all new customer cards. If a different sale layout is set in the Selling Details tab of a customer’s card, this layout will be used instead.

- Select whether you're recording a quote, order (Not Basics), or invoice from the Sales Type list in the top-left corner.

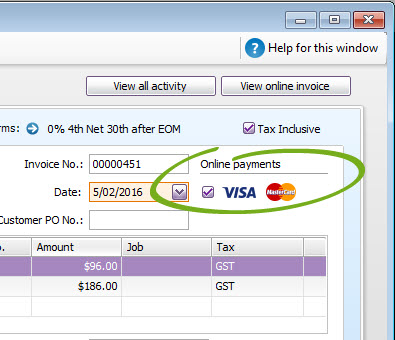

- (Australia only) If you've set up online payments, your customer will be able to pay this invoice online. If you don't want to offer online payments for this particular invoice, deselect the Online payments option.

Enter details of what you're selling, as well as headings, subtotals and blank lines. The fields that are available depend on the sale type and layout you've selected.

Adding services to an item invoice To include a service on an item invoice, create an item for the service, such as Labour Charge, and add the item to your invoice.

Item sale fieldsItem sale fields

Field Description Ship Enter the quantity to be delivered. If you don't have enough stock on hand, the Backorder List window will appear when you click Record. You can then choose whether you want to backorder, buy or build more items. Backorder

(Not Basics)Enter the quantity of the item to be placed on backorder. An order for this amount will be created automatically when you click Record. Learn more about building, buying or backordering items. Item Number Enter an item from your item list. Only active items will be listed. Description A description of the item appears automatically. You can change this if you want. If you want to check spelling in this field, click Spell. Price The price of the item appears automatically. You can change this if you want. Disc% [Optional] If you're giving the customer a discount, type it as a percentage. If you're giving them a dollar discount, enter the updated price in the Total column, and the discount percentage will be calculated for you. Total The total price of the items is calculated automatically. If you change the total, the Disc% field is updated to show the discount applicable. Job [Optional] Select a job number here to assign a line item to a specific job. Tax/GST The default tax (Australia) or GST (New Zealand) code for an item appears here. If you want to change it, enter the required tax/GST code. Service, Professional, and Miscellaneous sale fieldsService, Professional, and Miscellaneous sale fields

Field Description Description Enter a description of the goods or services being sold. If you want to check spelling in this field, click Spell. Acct No. or Account Name Enter the account to which to allocate the sale. This is usually an income account. You should not select your trade debtors account for ordinary sales. An AccountRight preference controls whether this field shows account number or name (Setup > Preferences > Windows > Select and Display Account Name, Not Account Number). Amount Enter the amount of the sale. Job [Optional] Select a job number here to assign a line item to a specific job. Tax/GST Select a tax code (Australia) or GST code (New Zealand) for the sale. Enter any charges for freight, and if required, select the right tax/GST code.

Calculated tax/GST

Click the zoom arrow next to the Tax/GST field to view or change the tax (Australia) or GST (New Zealand) amounts assigned to the sale. Be aware that changes to a transaction's calculated tax/GST won't be reflected in BASlink or GST Return calculations.

Enter an amount in the Paid Today field to record the amount the customer paid you at the time of the sale. If you are creating an order, record the amount the customer gave you as a deposit.

Click Details if you want to enter details about the payment. For example, if you are being paid by credit card, you can record the last four digits of the credit card number.Click Record (or Save Quote for quotes) to just save the sale, or click Print to also print it on your form stationery. Or click Send To to email the sale (you'll need to set up your email first) or save it as a PDF (not available for Miscellaneous sales).

Do you regularly record similar sales? Save time by saving the sale as a recurring transaction.

Sales FAQs

How do I add the items and expenses related to a job?

Click Reimburse to see a list of all the job purchases and expenses you have assigned a job number to, that can now be reimbursed on the sale.

What is the Customer PO No. field used for?

If the customer gave you a purchase order for this transaction, you can enter that purchase order number in the Customer PO No. field. You can search for sales by the customer's purchase order number.

Can I display tax/GST on each line of an invoice?

Yes. You can personalise the invoice form to add the Line Tax field. Then when you email or print the invoice it will display tax/GST on each line.

Here's how:

- Go to the Setup menu and choose Customise Forms.

- Select the invoice form to be customised then click Customise.

- Right-click on the form where the transaction lines are displayed and choose Show/Hide Columns.

- In the Available Columns list, click Line Tax then click Show.

- Click OK.

- Click Print Preview to see what the form will look like.

- Make any necessary changes.

- When you're happy with the changes, save the form.

Is there an easy way to copy the sale’s information into a purchase order?

Yes, you can record the sale and create a purchase order at the same time.

How do I record a note about the sale for my records?

You can enter a brief description in the Journal Memo field when entering the sale.

You can then search for sales using the text you enter in this field. If you don't want this information to appear on printed/emailed sales, ensure that the Memo field is not included on the form.

How do I edit the list of comments, shipping methods or referral sources?

To add, edit or delete the list of comments, shipping methods, referral sources and payment methods, go to the Lists menu > Sales and Purchases Information window.

You can also type a comment directly into the Comment field. This is an easy way to add a note to the customer's invoice.

To set the default comment for a customer, select it in the Sale Comment field in the cusrtomer's card (Card File > Cards List > open the card > Selling Details tab > Sale Comment).

Can I print packing slips with invoices and orders?

Yes. You can print a packing slip for sales (invoices, quotes and orders) which have been entered using the Service, Item or Professional layout.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.