- Created by BrianQ, last modified by StevenR on Sep 24, 2015

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 34 Next »

https://help.myob.com/wiki/x/HImU

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

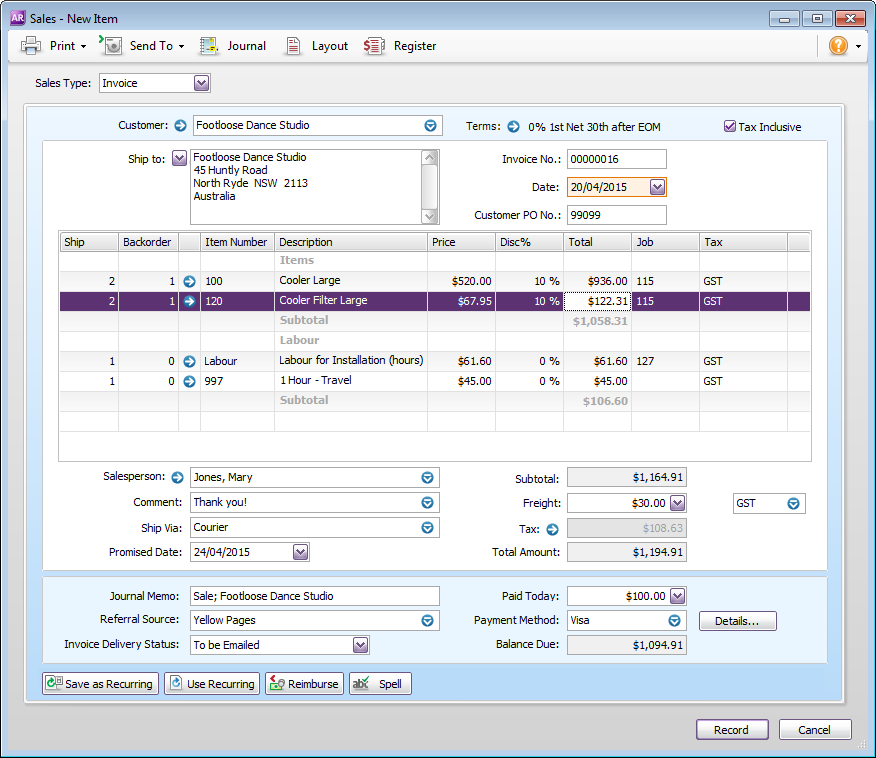

Made a sale? Great, now you can record the quote, order or invoice in AccountRight. And don't worry, if you make a mistake (like missing a line or entering the wrong amount), you can edit the sale later (so long as your security settings allow it). You can also personalise the forms you print and email.

Want to invoice using your smartphone? If your company file is online, try MYOB OnTheGo - it's a free iOS and Android app that works great with your AccountRight software.

- Go to the Sales command centre and click Enter Sales.

- Select the customer, or add a card for them.

- Are the credit terms right? Click the Terms arrow to change the customer's default credit terms for this sale only.

- If you're entering prices that include tax or GST, select the Tax Inclusive (Australia) or GST Inclusive (New Zealand) option. Don't change this setting after you start entering amounts.

- Want to change the sale layout to suit the type of goods or services you're providing? Click Layout.

- Select whether you're recording a quote, order (Not Basics), or invoice from the Sales Type list in the top-left corner.

Enter details of what you're selling, as well as headings, subtotals and blank lines. The fields that are available depend on the sale type and layout you've selected.

Item sale fields

Field Description Ship Enter the quantity to be delivered. If you don't have enough stock on hand, the Backorder List window will appear when you click Record. You can then choose whether you want to backorder, buy or build more items. Backorder

(Not Basics)Enter the quantity of the item to be placed on backorder. An order for this amount will be created automatically when you click Record. Item Number Enter an item from your item list. Description A description of the item appears automatically. You can change this if you want. If you want to check spelling in this field, click Spell. Price The price of the item appears automatically. You can change this if you want. Disc% [Optional] If you're giving the customer a discount, type it as a percentage. If you're giving them a dollar discount, enter the updated price in the Total column, and the discount percentage will be calculated for you. Total The total price of the items is calculated automatically. If you change the total, the Disc% field is updated to show the discount applicable. Job [Optional] Select a job number here to assign a line item to a specific job. Tax/GST The default tax (Australia) or GST (New Zealand) code for an item appears here. If you want to change it, enter the required tax/GST code. Service, Professional, and Miscellaneous sale fields

Field Description Description Enter a description of the goods or services being sold. If you want to check spelling in this field, click Spell. Acct No. or Account Name Enter the account to which to allocate the sale. This is usually an income account. You should not select your trade debtors account for ordinary sales. Amount Enter the amount of the sale. Job [Optional] Select a job number here to assign a line item to a specific job. Tax/GST Select a tax code (Australia) or GST code (New Zealand) for the sale. Enter any charges for freight, and if required, select the right tax/GST code.

Enter an amount in the Paid Today field to record the amount the customer paid you at the time of the sale. If you are creating an order, record the amount the customer gave you as a deposit.

Click Details if you want to enter details about the payment. For example, if you are being paid by credit card, you can record the last four digits of the credit card number.Click Record (or Save Quote for quotes) to just save the sale, or click Print to also print it on your form stationery. Or click Send To to email the sale (you'll need to set up your email first) or save it as a PDF(not available for Miscellaneous sales).

FAQs

Getting an error when entering a sale?

If you're using AVG antivirus software, and get a Huxley.Application has stopped working error when entering a sale, please update your AVG software. The issue was fixed in AVG 2015.0.6140.

Click Reimburse to see a list of all the job purchases and expenses you have assigned a job number to, that can now be reimbursed on the sale.

You should enter the credit limit you've assigned in each customer's card. If you want to stop sales from being recorded for customers who have exceeded their credit limit, you can place them on hold.

The default number shown in the Invoice No. field is the next available number. When you click in the Invoice No. field, Auto# appears to confirm that the number has been automatically selected for you. You can type a different number into the field if you want.

If the customer gave you a purchase order for this transaction, you can enter that purchase order number in the Customer PO No. field. You can search for sales by the customer's purchase order number.

Yes. The default sale layout displayed in the Sales window is determined by the selection you made when setting up sales details (using the Sales Easy Setup Assistant). You can override this selection in the Selling Details tab of the customer’s card.

You can also choose the default customised form to use when printing or emailing a sale to a customer.

Yes. You can personalise the invoice form to add the Line Tax field. Then when you email or print the invoice it will display tax/GST on each line.

Here's how:

- Go to the Setup menu and choose Customise Forms.

- Select the form to be customised then click Customise.

- Right-click on the form where the transaction lines are displayed and choose Show/Hide Columns.

- In the Available Columns list, click Line Tax then click Show.

- Click OK.

- Click Print Preview to see what the form will look like.

- Make any necessary changes.

- When you're happy with the changes, save the form.

Have you selected the Miscellaneous sale layout? This layout should only be used for sales where a form does not need to be printed or emailed. For example, bad debt write-offs.

If some sales you record are very similar, or you record them frequently, you can save the sale as a recurring transaction 'template' that you can use again.

Click Save as Recurring. In the Recurring Schedule Information window, enter the necessary information and click OK. If you've already saved a recurring sale, click Use Recurring to create a sale based on the recurring transaction.

Click the Tax arrow if you want to view or change the tax (Australia) or GST (New Zealand) amounts assigned to the sale.

Yes, if you want to record the sale and create a purchase order at the same time, click Create PO. The quote or order is recorded and the Purchases window appears.

You can enter a brief description in the Journal Memo field. You can search for sales using the text you enter in this field. If you don't want this information to appear on printed/emailed sales, ensure that the Memo field is not included on the form.

To add, edit or delete the list of comments, shipping methods, referral sources and payment methods, go to the Lists menu > Sales and Purchases Information window.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.